Front Porch Blog

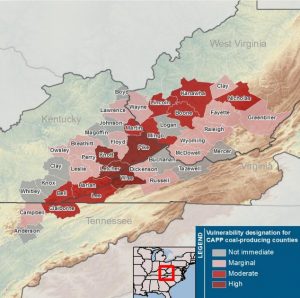

James River Coal, which entered bankruptcy this week, has operations in Central Appalchia’s most economically vulnerable coal-producing counties. Click to enlarge.

This week, James River Coal Company filed for Chapter 11 bankruptcy protection in federal court. Like Patriot Coal, which reemerged from bankruptcy in December, the Richmond, Va.-based company’s operations are concentrated in Central Appalachia and are located in some of the counties most economically vulnerable to coal’s downturn.

According to a 2013 report by Downstream Strategies, eastern Kentucky’s Knott, Letcher, Pike, Bell, and Harlan counties are particularly vulnerable to shifting coal demand and changes in electricity markets, and therefore, require the most immediate attention from policymakers seeking to alleviate the economic impacts of the region’s declining coal industry.

James River has historically operated in all of those counties. But in September 2013, poor demand forced the company to lay off 525 employees and idle production at its McCoy-Elkhorn complex in Pike and Floyd counties and the Bledsoe complex in Leslie and Harlan counties.

Two months later, the struggling coal operator idled four more mines and furloughed 200 workers.

James River has not posted an annual net profit since 2010 and reported net loss of approximately $16.4 million in 2013. Investors expected the bankruptcy was imminent after the company recently received a notice from Nasdaq that it was not complying with the stock market’s rules after its stock closed below $1 per share for 30 business days.

In its bankruptcy filing, the company said it has assets valued at about $1.06 billion and liabilities of about $818.7 million, according to the Richmond Times-Dispatch.

“The coal markets in the U.S. have changed dramatically during the past several years,” said James River Chairman and CEO Peter T. Socha. “Some of these changes are cyclical due to continued weakness in the real economy. Other of the changes are more permanent like changes in government environmental regulations, improved methods to produce natural gas, and switching between coal basins by domestic power utilities.”

A federal judge approved James River’s request to continue operations during its restructuring process, including paying wages and providing health care and other benefits to its 1,200 employees.

The company also appears committed to carrying out its contracts with electric utilities such as Indianapolis Power & Light, and Kentucky Utilities Co., which it supplies with coal from more productive mines in the Illinois Basin.

Either way, according to SNL Energy, James River’s chances for survival post-bankruptcy could be hindered by expiring contracts with electric utilities and the shrinking demand for Central Appalachian coal.

PREVIOUS

NEXT

Related News

Leave a comment

Your email address will not be published. Required fields are marked *

Solar, wind, geo-thermal:America helps save the environment as well as restore it’s economic prosperity!