Posts Tagged ‘Electric Utilities’

Hydrogen gas — what’s all the hype about?

Hydrogen gas as an energy source in Central Appalachia is a real possibility, so we’re unpacking this technology and exploring its potential impact on the health of communities and ecosystems in our region.

Read MoreDemocracy in action

Voting an exercise in community. It’s an exercise in finding ways in each of our own lives that build a more equitable and resilient community that works for all of us.

Read MoreNo Easy Answers on Coal Ash Cleanup

To protect groundwater and community health, coal ash ponds must be cleaned up. But, as communities in Tennessee have learned, safely removing the toxic waste brings its own set of challenges.

Read MoreSolar Panels on Southwest Virginia Schools Signal a Diversifying Economy

School solar projects demonstrate how Virginia’s coalfield counties are diversifying their economies and energy options with solar power.

Read MoreThe Sun is Shining on Southwest Virginia’s Growing Solar Industry

Learn about several exciting updates on the bright future for Southwest Virginia’s growing solar energy industry, broken down into four categories: 1) residential solar, 2) commercial solar, 3) utility solar and 4) shared solar!

Read MoreKnoxville community groups call for affordable utilities

The Knoxville Water and Energy for All campaign is made up of community and faith groups with a mission to bring solutions to the root problems of unaffordable bills and disconnections in Knoxville.

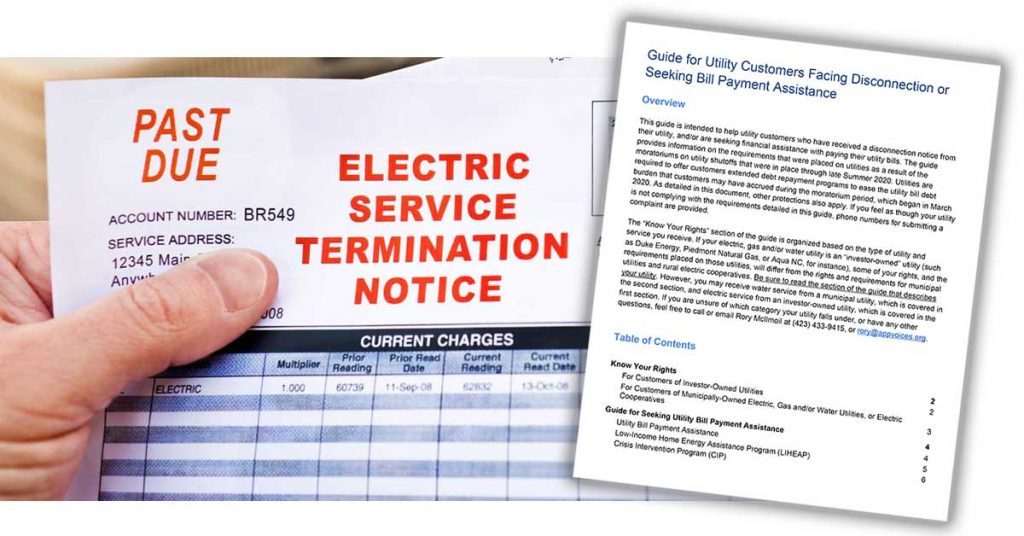

Read MoreNC Utility Customers: Know your rights and resources

We put together a resource guide for residents in North Carolina who are in danger of having vital water and electric services disconnected during the pandemic.

Read MoreNC groups call for prohibition of all utility shut-offs in state due to covid-19

CONTACT: Al Ripley, Director Consumer, Housing and Energy Project NC Justice Center (919) 274-8245 al@ncjustice.org Rory McIlmoil, Senior Energy Analyst Appalachian Voices (828) 262-3385 rory@appvoices.org RALEIGH — Nearly 30 organizations serving communities across North Carolina sent a letter today commending the NC Utilities Commission for its recent order directing all utilities it regulates to immediately…

Read MoreVirginia Legislature Passes Clean Economy Act

The Clean Economy Act would require Virginia to transition to 100 percent renewable energy and emit no carbon from the power sector by 2050.

Read MoreElectric Utility News From Around the Region

News updates concerning the Tennessee Valley Authority, Duke Energy, Old Dominion Power, Dominion Energy, and local power companies.

Read More