Front Porch Blog

![]() Special to the Front Porch: Autumn Long is director of the Appalachian Solar Finance Fund. (This was initially posted on the SFF website.)

Special to the Front Porch: Autumn Long is director of the Appalachian Solar Finance Fund. (This was initially posted on the SFF website.)

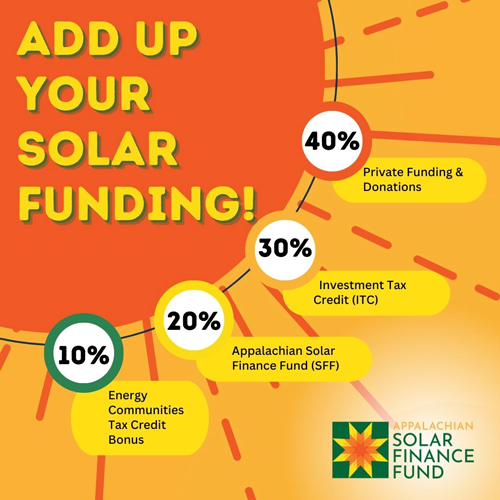

Going solar has become more accessible and affordable for nonprofit organizations, businesses and local governments in Appalachia. Communities near a recently closed coal mine or coal-fired power plant directly benefit from significant federal funding flowing into the region. NOW is the time to act if you’ve considered adding solar panels to your building. Reduce your energy bills and support local clean energy jobs!

- The federal solar Investment Tax Credit returns to 30% of total project cost for solar installations built through 2033. You could get a significant tax credit for going solar at your home or business! The Office of Energy Efficiency and Renewable Energy has more information.

- This tax credit is essentially becoming a grant for tax-exempt organizations, including nonprofits, schools, churches, and local governments. The IRA establishes a direct or “elective” payment mechanism that enables tax-exempt entities (like local governments and nonprofit organizations) to take advantage of the ITC for the first time. Through elective payment, the federal government will refund the value of the tax credit to an entity regardless of whether that entity is subject to income tax. This means that tax-exempt entities, including 501(c) nonprofit organizations, state/local/Tribal governments, publicly owned utilities, and rural electric cooperatives, will receive the ITC’s equivalent value as a direct payment from the U.S. Treasury. For example, if a public library invests $125,000 to install a 50-kilowatt solar array on its roof, the library can register to receive a payment of $37,500 from the federal government. Proposed U.S. Treasury guidance on ITC direct/elective pay is available for review, and the Internal Revenue Service has a list of frequently asked questions.

- Businesses and nonprofits sited in qualified “energy communities” — including much of Appalachia — get an additional 10% tax credit bonus for solar and other clean energy projects. Eligible locations include census tracts with or adjacent to a recently closed coal mine or coal-fired power plant; communities with qualifying levels of direct employment or local tax revenues related to coal, oil, or natural gas extraction and unemployment rates at or above the national average; and brownfield sites. More information about the federal Energy Community Tax Credit Bonus is available online, including a map of eligible census tracts. (Note: Brownfield sites are not included in the map, but projects on specific brownfield sites remain eligible for the Energy Community Tax Credit Bonus)

- Solar energy projects built in low-income communities in 2023 and 2024 may qualify for an additional 10% Low-Income Communities Tax Credit Bonus, with a 20% tax credit bonus available for projects deemed part of a “qualified low-income residential building or project” or a “qualified low-income economic benefit project.” These credits will be allocated based on an application and award process that is currently under development by the U.S. Treasury Department, with a 1.8-gigawatt annual total program allocation limit. The IRS has proposed regulations and additional guidance on the Low-Income Communities Tax Credit Bonus are available for review.

Nonprofits and public institutions can stack federal reimbursements and grants for solar installations

Many coal-impacted Central Appalachian counties located within the Appalachian Solar Finance Fund’s service area may also be eligible for the federal Energy Community Tax Credit Bonus and/or a Low-Income Communities Tax Credit Bonus. Refer to this custom map to find out whether your location is eligible for SFF support and the federal Energy Community Tax Credit Bonus. The SFF can provide stackable grant funding to leverage these federal incentives for solar projects on nonprofit and public institutions, including the cost of pre-solar roof repairs/replacement. The SFF generally will consider funding up to 20% of a solar project’s total cost, with a negotiable cap of $20,000 for roof repairs/replacement.

Commercial businesses serving community good can benefit, too!

The SFF also provides technical assistance cost support for solar predevelopment on local commercial businesses, nonprofits, and public entities. Eligible technical assistance services include scoping/feasibility studies, grant writing, energy auditing, engineering and design, jurisdictional permitting and inspection, utility interconnection, workforce development programming, etc.

Repayable financing and credit enhancements

Last but certainly not least, through our partner Invest Appalachia, the SFF can provide repayable solar project financing and credit enhancements, including low- to zero-interest ITC bridge loans, interest rate buydowns, and loan guarantees. We’ve put together a guide about Invest Appalachia’s clean energy credit enhancements.

With such a broad range of financial resources now available, there has never been a better time to go solar, lower your electricity costs, and honor Central Appalachia’s long legacy of energy production by supporting the growth of a vibrant new 21st-century clean energy economy in our region’s local communities.

To learn more about the SFF and apply for funding support for your solar project, visit solarfinancefund.org.

PREVIOUS

NEXT

Related News

Leave a comment

Your email address will not be published. Required fields are marked *

Leave a Comment