Front Porch Blog

Special to the Front Porch: Richard Miller is a former congressional staffer and served as the Labor Policy Director for the Committee on Education and Labor. (This was initially posted on Confined Space, a newsletter of workplace safety and labor issues.)

Special to the Front Porch: Richard Miller is a former congressional staffer and served as the Labor Policy Director for the Committee on Education and Labor. (This was initially posted on Confined Space, a newsletter of workplace safety and labor issues.)

This three-part guest blog examines the lengths coal companies will go to in order to evade their obligations to miners who develop black lung while working for them. Part I explained black lung and the benefit system in place for miners with the disease. Part II discussed how companies short-change that system. Part III below examines potential solutions.

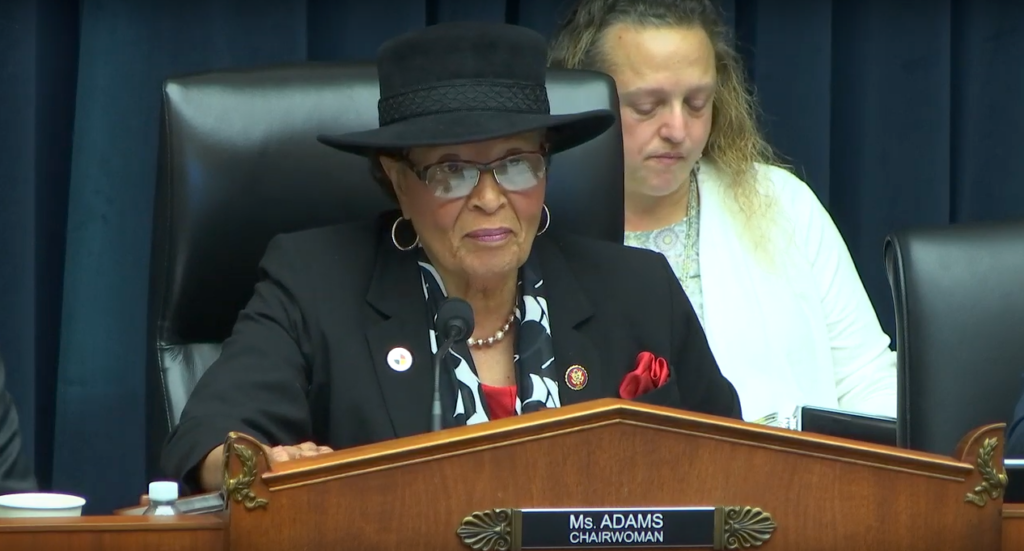

Members of the Black Lung Association attend congressional hearing in 2019. Photo by Earl Dotter

The Labor Department proposes a fix

In 2021, the Government Accountability Office found big problems with the Labor Department’s current rules because they do not require sufficient collateral to cover both current and future black lung liabilities. Moreover, the Labor Department is not required to update coal operators’ collateral levels on a regular basis to ensure that the coal operators have enough money set aside to fund their black lung liabilities.

And the problem has not gotten better. In January 2023, the Labor Department estimated that self-insured operators have another $700 million in self-insured black lung liabilities, but reserved only $120 million (17%) in collateral. GAO repeatedly urged the Labor Department to fix this broken system in congressional testimony.

To protect the Black Lung Trust Fund, the Labor Department proposed a rule in January that would tighten its self-insurance rules. It would require self-insured operators to provide surety equal to 120% of their current and future black lung benefit liabilities. In April, U.S. Reps. Bobby Scott, D-Virginia, and Alma Adams, D-North Carolina, commented that this proposal is “an elegant, reasonable and prudent solution.”

However, this reform is causing no shortage of gnashing of teeth, if not hysteria, in the C-suites of the coal companies. The same coal companies that gamed the system are now claiming that the new Labor Department proposal will drive them to the brink.

U.S. Rep. Alma Adams (D-NC), chairwoman of the U.S. House Workforce Protections Subcommittee, convened a 2020 hearing to address a federal report revealing years of government negligence. Public domain photo

They argue that it’s not fair for the Labor Department to change the rules because they had already made “irreversible business decisions based on the Labor Department’s historic practices.”

In other words, we’ve become dependent on your failed rules, so it’s not fair to fix them now.

Unpacking these arguments, it appears these operators simply want to continue to under-insure, because it is cheaper, and they know the risk from under-insurance will just be transferred to the taxpayers, via the trust fund.

Given that the predecessor to Alpha Metallurgical Resources was able to shift nearly $500 million in liabilities to the trust fund while providing less than 3% collateral, what rational executive wouldn’t want to keep this sweet deal?

Warrior Met is crying foul that the Labor Department is proposing to boost their surety bonding from $21 million to $68 million. But this company has been awash in cash in recent years, having transferred around $1.5 billion in dividends to their shareholders and $50-plus million in stock buybacks since 2017.

So cry me a river.

In an April 19, 2023, comment letter, Peabody Coal criticized the Labor Department’s proposal requiring them to post collateral equal to 120% of their estimated liabilities because this means they would have to set aside money that could go to its shareholders. And they are refreshingly honest about it.

Peabody says it has “$1.3 billion in cash on the books,” and just announced a $1 billion stock buy-back plan. They argue that this rule would tie “up cash and/or Letter of Credit capacity that prevents the company from operating efficiently.” Their loyalty is to their shareholders, not their ailing workers. For Peabody executives, keeping the current rules is just peachy.

Peabody also contends that they should not have to post 120% collateral, because they “paid $32.4 million in black lung excise tax to fund the trust fund” last year. They write: “If the collateral [collected from operators] completely eliminates any possibility of the trust paying claims, then it calls into question the purpose for the fund and the excise tax.”

Apparently, Peabody overlooked that the trust fund is $6 billion in debt, which includes close to $230 million in Peabody’s black lung liabilities that were transferred to the trust fund via the Patriot Coal bankruptcy. Perhaps the Peabody executives wanted to skip over that inconvenient fact. Or maybe they’re just forgetful. However, paying this modest excise tax is a way to start repaying the debt Peabody heaped on the trust fund. And the Labor Department proposal ensures that future bankruptcies won’t be adding more red ink.

The National Mining Association commented “that bankruptcies are not a major threat to the trust fund.” They apparently think the red ink (and the risk of more) is too insignificant to justify reforms to self-insurance. They want a system where operators are not even required to pledge “specific assets as collateral” so long their credit rating is sound. This “trust me” proposal allows operators to under-insure, and, when things go south, whoops! It is too late for the Labor Department to secure funds from an ailing operator.

The United Mine Workers of America, the Appalachian Citizens Law Center, the National Black Lung Association, Appalachian Voices and a related citizens petition signed by over 4,800 individuals supported the Labor Department’s rule and addressed many of the industry’s objections:

- The 120% collateral requirement is reasonable: Many state workers’ compensation programs require more than 100% in collateral from self-insured employers. For example, Alaska requires 125%, Arizona requires 125%, Minnesota requires 110%, North Carolina requires 100%, Tennessee requires 125%, and Texas requires 125% (although workers’ comp is optional in Texas). This responds to NMA’s earlier position that even “70%, 85% or 100% as security for liability insurance is burdensome and unreasonable.”

- Requiring 120% collateral provides a buffer for rising medical costs and more claims: As documented by NIOSH, the most severe form of black lung is increasingly diagnosed in younger miners; meanwhile, procedures such as lung transplants — which will cost north of $1 million — are available for some miners.

- Operators have multiple options to cover the costs of black lung: They don’t have to self-insure if it is too costly under this rule; they can simply purchase commercial workers’ compensation insurance. Nothing in the Black Lung Benefits Act requires the Labor Department to adopt a rule that permits operators to self-insure for less than current and future liabilities. If an insurer won’t indemnify existing claims, operators can post collateral such as Treasury bills from which they can draw interest. What operators cannot do is get a free ride.

Why do we care?

The solvency of the trust fund is integral to the workings of the black lung program, and miners and taxpayers face multiple risks by allowing operators to pile more red ink on the taxpayers.

When the trust fund faced a growing mountain of debt in 1981, the industry won legislation to cut benefit eligibility in exchange for a higher excise tax rate. It took until 2010 when the Affordable Care Act was passed to reverse these deep benefit cuts; but in that 30-year window, far too many miners and survivors were denied benefits.

Last year, House Education and Labor Committee Republicans offered an amendment during a mark-up of black lung legislation that could coerce miners into accepting a partial settlement in lieu of full benefits. The Black Lung Association, which advocates for miners safety and benefits, warns that growing debt levels in the trust fund could once again be used by the industry as political cover to cut miners’ benefits.

Perverse incentives: More black lung?

The BLA points out that allowing self-insured operators to dodge payment for black lung benefits establishes a perverse incentive, whereby a significant cost — compensating black lung disease from the failure to control harmful dust levels — is not included in the cost of coal production. While internalizing these costs will not ensure safer mines — that requires much stronger standards and enforcement — evading payment provides far less incentive for coal operators to control dust to a low enough level that prevents black lung disease over a lifetime of work.

Moral hazard: Taxpayers pay for operators’ cost-shifting?

Government permission to under-insure current and future benefits means the trust fund (and taxpayers if it is insolvent) will subsidize the cost of black lung disease. This creates a moral hazard where responsible coal operators have little incentive to guard against that risk because they are improperly allowed to shift the cost to taxpayers.

As Sen. Robert C. Byrd noted in 2010, “… black lung benefits have been promised to coal miners who have acquired this totally disabling disease through no fault of their own … [it would] not cost [companies] one additional dime, unless [these] employers took insufficient precautions to protect their workers from black lung disease.”

PREVIOUS

NEXT

Related News

Leave a comment

Your email address will not be published. Required fields are marked *

Leave a Comment