Energy Tax Credits

The energy tax credits established in the 2022 Inflation Reduction Act are creating jobs and saving people money across Appalachia. Provisions such as the bonus tax credit for energy communities, the bonus tax credits for low-income projects, incentives to promote domestic manufacturing of energy equipment, and "direct pay" or elective pay option for tax-exempt entities, have been a game changer for American-made solar energy. Check out these case studies to see how these tax credits are providing Appalachians with reliable, affordable, home-grown power.

Clawson-Burnley Park

The town of Boone, North Carolina, has an ambitious goal to install three megawatts of distributed energy resources by 2030, in order to reduce transmission costs and provide more localized, reliable energy sources. One of the first steps towards reaching this target is the recent installation of solar arrays at Clawson-Burnley Park, a project that highlights the town’s dedication to clean energy.

Faith Lutheran Church

In February 2023, Faith Lutheran Church in Oak Ridge, Tennessee, contracted with Knoxville-based firm Solar Alliance to install a 15.3-kilowatt photovoltaic system. Faith Lutheran received a tax rebate through the Inflation Reduction Act’s Investment Tax Credit, as well as a grant from the Appalachian Solar Finance Fund.

The system is expected to provide a lifetime financial benefit of $67,791.

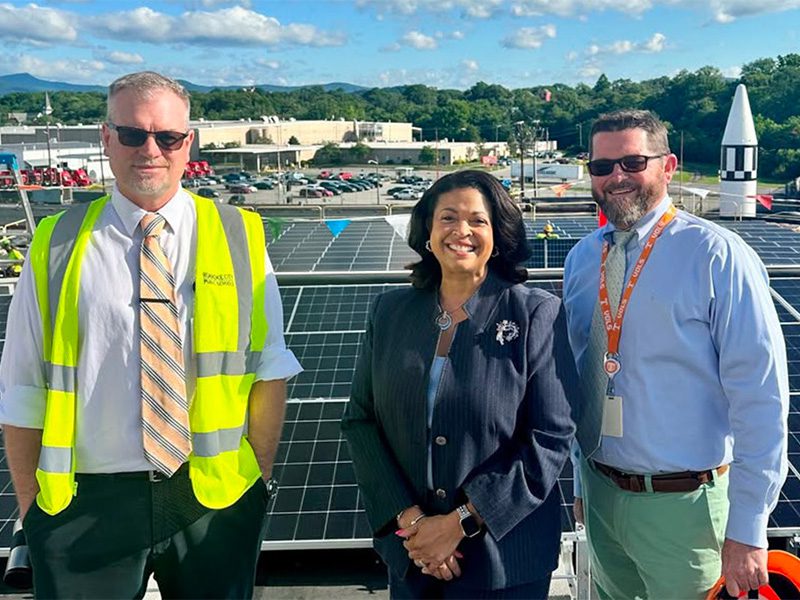

Just for Kids

This project consisted of installing a solar array onto a the Just for Kids Child Advocacy Center, a haven for children who have experienced sexual abuse or violence. The installation is projected to provide 100% of the electricity needed for the building, a projected lifetime savings of over $32,487.

Lee County Schools

When Lee County Public Schools decided to install solar on schools, leadership saw it as not only a way to save money, but also to provide an educational and workforce training opportunity for its students. Six students participated in the installation process—they got paid and also received community college credit from nearby Mountain Empire Community College.

Middlesboro Community Center

The city of Middlesboro has deep ties to the coal industry – it was originally founded with the goal of making it the “Pittsburgh of Appalachia.” At the end of 2023, Middlesboro Community Center completed a 162-panel, 63.18 kW solar installation, a project guaranteed to save the city $8,500 a year in electricity expenses.