Betting the Farm on a “Wild West” Hemp Economy in Appalachia

Kris Gupton and his wife Heather Bryant have grown hemp in Western North Carolina for four years. A pending state bill poses new threats to N.C. growers, but Bryant and Gupton say they are committed to farming hemp. Photo courtesy of Heather Bryant and Kris Gupton

Union, W.Va, a tiny, no-stoplight town in southeastern West Virginia, is the hotbed — literally and figuratively — of the emerging hemp economy in Appalachia. That’s because the hemp farmers here in Monroe County are hot at the state Department of Agriculture for destroying much of their crop this past growing season because they were deemed too “hot” — that is, over the ceiling of 0.3 percent THC set for industrial hemp. Those regulations were approved by the U.S. Department of Agriculture under the federal farm bill that became law in December 2018.

Many West Virginia farmers had difficulty staying under the THC ceiling because of the method the state used to test THC levels. As opposed to just testing delta-9 THC, as some other states had done, West Virginia also tests THC-A levels. Delta-9 THC is the primary psychoactive ingredient in marijuana. Only tiny traces of it are found in industrial hemp. THC-A is non-psychoactive but can become delta-9 THC when heated. Yet, THC-A will increase total THC concentrations.

That won’t change in 2020 because the U.S. Department of Agriculture has temporarily adopted proposed regulations virtually identical to those used by West Virginia in 2019. The USDA closed the comment period on Jan. 31, 2020, for the establishment of a domestic hemp program under the 2018 bill. So, through at least Nov. 1, 2021, the new guidelines will apply to farmers in every state.

Prior to 2018, the 2014 U.S. Farm Bill stated that the only lawful purpose for which industrial hemp may be grown is for research conducted by an institute of higher education or a state department of agriculture. The 2018 bill, however, identified hemp as an agricultural plant, not a controlled substance.

What is Hemp?

Hemp is a cannabis plant grown for its flowers, seeds, fibers and stalks, as well as for biomass, where the entire plant is chopped up. It has been grown by humans for at least 12,000 years. In the past, it was used for fiber, food, paper, oil, textiles and rope, and it is one of the oldest domesticated plants.Its decline in production coincided with a high federal tax imposed upon it in 1937, as well as with technological advances such as the invention of nylon, which was first used in 1935. Then, in 1970, Congress passed the Controlled Substances Act, which listed marijuana as a Schedule 1 substance, which also includes drugs such as heroin and LSD — meaning that it is considered to be among the most harmful of drugs. At the time, industrial hemp was not distinguished from marijuana.

“Literally Betting the Farm”

As farmers prepare for the 2020 season, they do so with uncertainty. Yet, each season offers new opportunities.

Experience, of course, is the best teacher. So, I met with five West Virginia hemp farmers — Don Dransfield, Brian Wickline, Dirk McCormick, Sonya Fullen and Don Smith II. I also toured Wickline’s farm in Union.

Monroe County comprises 474 square miles in the Greenbrier Valley, providing farmers with some of the richest and most open farmland in the Mountain State. Yet, Dransfield says that growing hemp is “literally betting the farm.” That is because hemp farming is not only risky, but also quite expensive.

In Monroe County, W.Va., farmer Brian Wickline stands by 10 pounds of hemp flower. He is pursuing hemp to help diversify his dairy farm. Photo by Michael M. Barrick

For 2019’s crop, Wickline took out a loan. But because he has not been able to move the flowers from that harvest as expected, he paid only the interest this year so that he could grow during the 2020 season. He explains that such risk-taking has become business as usual in farming.

Sonya Fullen grew up on a farm in Greenville, in the center of the county. Her husband is a sixth generation farmer, and her father was a well-known agronomist in the region. They grow outdoors for CBD, using both cuttings and clones. Their overhead was close to $20,000, yet two-thirds of their crops had to be destroyed because they exceeded the 0.3 percent THC threshold. What was left had limited value, because it was low in CBD.

They financed their operation without a loan. Still, Fullen isn’t giving in. She recently visited a veterinarian conference in Asheville, N.C., to explore the possibility of using CBD extract as medicine for animals.

Dirk McCormick started growing hemp because of personal experience and prodding from his daughter. He says he bought his first bottle of CBD oil for $79. It lasted 45 days. “It helped with pain,” he says. He adds, “We took a huge risk to make a profit because nothing else is selling.”

The other problems West Virginia farmers faced in staying under the THC ceiling had to do with the state’s testing methods and timing. Regulators would test a few samples from a field in late summer, cutting off the top 6 inches of the plant to assess it. Farmers argue that biomass should be tested, as that would give a more accurate reading of the whole plant. Additionally, they note, the longer the plant is in the ground, the more CBD — and THC — is going to be present. From the testing date, farmers have only a couple of weeks to harvest the crop. It also means a later planting time so that the THC levels are not too high when the state tests the plants.

The CBD Market Explodes

Meanwhile, at the other end of the supply chain, the CBD market exploded following the 2014 and 2018 laws. Yet, while farmers are highly regulated, the same is not the case at the retail end.

The result was an Economics 101 lesson in supply and demand. Most farmers in the region grew floral hemp for the cannabidiol, or CBD, industry.

CBD and THC are both present in hemp and marijuana. THC has psychoactive effects, or what is commonly known as being high. A marijuna plant can have THC levels as high as 20 percent or more. Legal CBD, meanwhile, must be under 0.3 percent THC, so it does not get a person high; it is used to treat pain, including osteoarthritis, rheumatoid arthritis and inflammation. CBD is also an FDA-approved treatment for epilepsy and showed no indication of physical dependence in trials.

So for farmers struggling to stay afloat, the passage of the 2018 Farm Bill paved the way for those who had been part of the initial trial and those willing to jump in for the first time to grow hemp for CBD. However, by harvest time, farmers throughout Appalachia discovered the CBD market flooded.

Barbara Volk, president of the West Virginia Herb Association, says, “Hemp farming is like the wild West.” She adds, “It’s confusing for consumers. There are lots of things on the store shelf that are not pure CBD products. If you go into a convenience store, if you’ll read the ingredients, it’s not pure.” Yet, she’s hopeful. “I believe the market is open to good products.”

Hemp farmer Heather Bryant transplants seedlings at her and her husband’s farm near Collettsville, N.C. Photo courtesy of Heather Bryant

“Out of three years of farming and 18 different hemp strains, only three of those have a total THC below that threshold,”Bryant wrote in an email. “Additionally, those three strains have below 10 percent CBD content, as the two are proportional to each other, i.e. low total THC equals low total CBD.”

Growers aim for somewhere between 4 to 16 percent CBD, and 10 percent is considered average, growers and retailers say. The higher the CBD level, the stronger the medicinal benefits. Bryant adds, “CBD is not really regulated at the retail level. However, we and many others have good manufacturing practices to ensure a properly labeled product. From what I’ve seen and heard, people shop with their eyes and go for an appealing label. What we are trying to do is sell our story along with our product. Consumers should definitely read the label of ingredients and maybe do some research on the company, if possible, as well as look for a sealed container.”

Blake Butler with the North Carolina Industrial Hemp Association agrees. “Everyone’s selling it. It’s a craze. Growers went along with it. Here’s the catch: we don’t have guidance from the [U.S.] Food and Drug Administration. How do we label it? Nobody taking CBD has been hurt that we know of. We know that the plant is valuable. It’s here for a reason.”

Speaking in confidence for business reasons, an operator of a CBD store in Western North Carolina expressed concern, saying, “I don’t know which way the wind is blowing. I don’t want to be caught holding inventory, but CBD products are popular.” Indeed, CBD dog treats in their store were $45 a gram. Two-ounce tincture bottles sold for $60. Smokable hemp ranged in price from about $5 to $15 a gram.

The store operator stated that the high demand for CBD oil extractors since the 2018 bill’s passage has led to the bottleneck in production due to an inadequate number of processors. Indeed, says Monroe County famer Brian Wickline, his most important priority for this season’s crop is to contract with “a proven, successful extractor.”

Expanding a “Wild West” Market

Bryant also says they’re not about to give in. She emphasizes the value of locally grown products, goes to different farmers markets, events and festivals, uses social media and has created an online store. She is also getting ready to open a store in downtown Lenoir, N.C., about 20 miles from their Caldwell County mountain home. The store will be dedicated to their hemp and its derivatives, in addition to many holistic herbs and alternative medicines.

Bryant also says they’re not about to give in. She emphasizes the value of locally grown products, goes to different farmers markets, events and festivals, uses social media and has created an online store. She is also getting ready to open a store in downtown Lenoir, N.C., about 20 miles from their Caldwell County mountain home. The store will be dedicated to their hemp and its derivatives, in addition to many holistic herbs and alternative medicines.

Growers, though, still need to adjust their thinking, says Butler. “We are working to get people to buy from farmers who grow for fiber. Everyone’s warming up to the idea. It’s just going to take some time. Growing for fiber is a whole lot easier than growing for CBD, but you make a lot less money. So, we need to get our farmers to see the benefits of a three- to five-year plan.”

Butler says that the “perfect scenario” would be if a clothing company like Patagonia would come in and take enough orders from local farmers. He observes, “That is a micro-economic example of how to bring a small town back to life.”

Don Smith in Tornado, W.Va., isn’t as hopeful. He works with Agri Carb Electric Corporation, a company that is looking for and developing markets for industrial hemp. He says the USDA guidelines are a huge barrier. Smith observes, “Fiber and feed [operations] and their subsequent downstream industries must be developed. But with this ridiculous, arbitrary and capricious 0.3 percent THC threshold, there is no way I can work up $57 million for a hemp manufacturing plant at the end of a hemp field. Telling investors that the USDA or WVDA will come in and burn down the crop if it tests hot for THC has the net effect of ruining the business plan. Who in their right mind would invest in something like that?”

“We simply must diversify the full cannabis market,” he says. “At first, it was mostly CBD. But we must develop new markets — biochar, activated charcoal, hemp fabrics, hemp and cardboard, hemp plastics, hempcrete and hemp graphene.”

Smith, who started advocating for medical cannabis after his wife was diagnosed with multiple sclerosis about 10 years ago, says, “At this time, I am pursuing legislation called medical hemp. If our crops spike up hot and above 0.3 percent THC, we simply convert to medical hemp status. Processing can thin down and control the amount of THC in downstream products.”

The Solution: Reciprocity and Determination

In light of the many challenges faced by hemp farmers, Barbra Volk of the West Virginia Herb Association says farmers and all in the industry must adopt a spirit of reciprocity. In short, those in the industry must continue to find more and better ways to cooperate with one another.

It will also include determination, says Don Smith, with West Virginia’s Agri Carb Electric Corporation. “Cannabis is the most beneficial plant on earth. There is more food, fiber, fuel and medicine on an acre of cannabis than any other plant on earth. The 83-year-old cannabis prohibition is the worst public policy miscalculation in history.” Yet, he confidently insists, “We’re bringing the cannabis prohibition to a close.”

© Michael M. Barrick, 2020.

Farmers Across Appalachia Affected

All states in Central and Southern Appalachia have legalized industrial hemp. Yet, as the 2020 growing season approaches, the new USDA rules concern the region’s farmers.

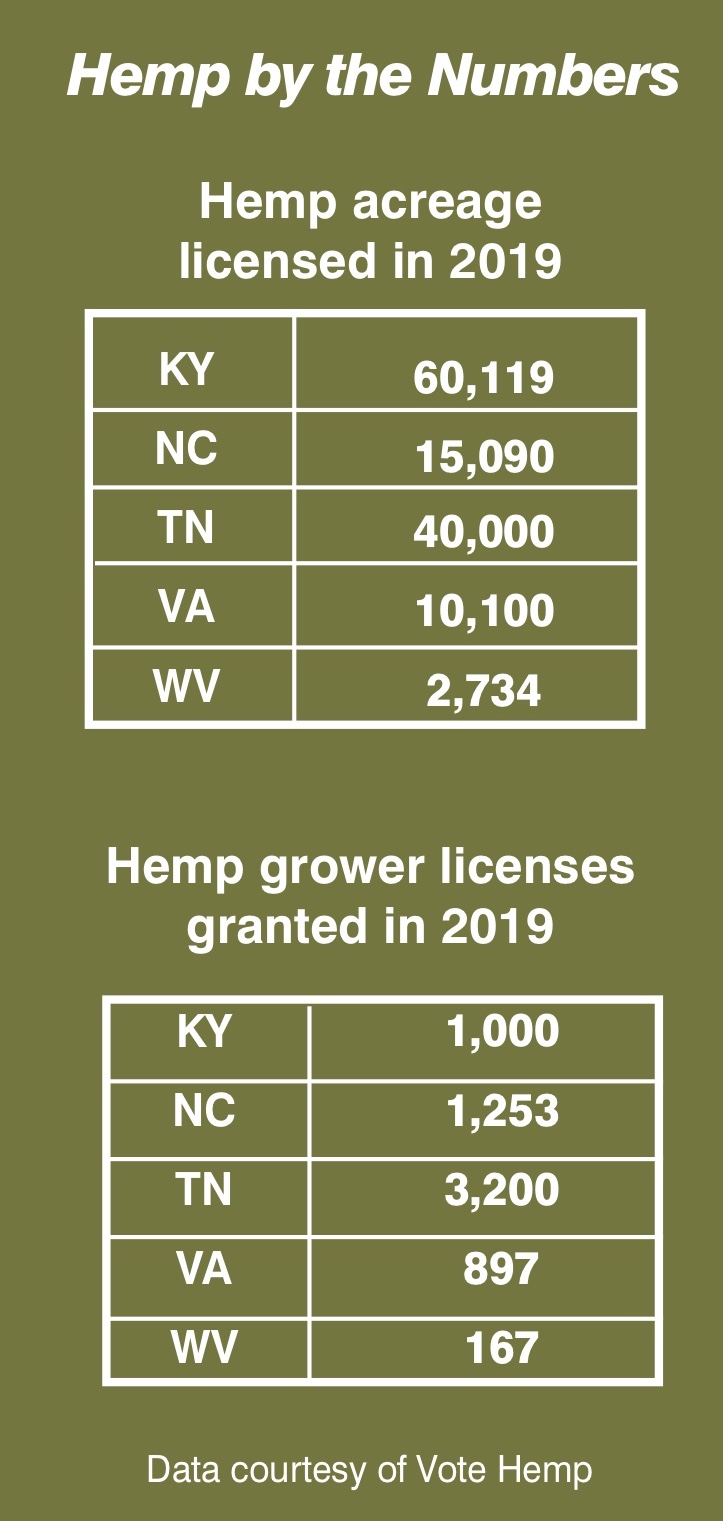

Blake Butler of the North Carolina Industrial Hemp Association notes that the state’s program has evolved from one that emphasized research as required by the 2014 Farm Bill into a state pilot program that has approved applications for 1,300 growers and 700 processors. Indeed in 2015, the N.C. General Assembly established the Industrial Hemp Commission to stay within federal laws, and the state continues to accept applications for its Industrial Hemp Pilot Program.

Additionally, the 2019 North Carolina Farm Act is in legislative limbo over issues unrelated to industrial hemp, such as hog waste disposal and legislative stalemates. Yet, industrial hemp provisions are in the bill, including a ban on smokable hemp. Butler admits, “I have no idea what the legislature is going to do.” However, the legislature is not scheduled to convene until April 28. Butler is hopeful farmers would have six months to adapt to any law changes.

Yet, the North Carolina Industrial Hemp Association — as well as farmers like Heather Bryant — are promising an aggressive fight against any legislation that would harm their fledgling industry, including the more conservative definition of THC and the criminalization of smokable hemp.

“We and many others are prepared for the class action lawsuit,” Bryant explains. “While [passage of the state bill] will hinder us with in-state sales, it does not restrict us from selling our crop out-of-state. North Carolinians will also still be able to purchase hemp online, as the federal government has made clear the interstate commerce cannot be stopped. It can be shipped via USPS. We will be able to boost other state’s economies with the sale of hemp, but North Carolina will get nothing from it.”

Indeed, the North Carolina Industrial Hemp Commission has issued a resolution in opposition to the proposed prohibition.

2020 is the final year of Kentucky’s research pilot program for hemp before the state transitions to a commercial program. In early February, the state legislature sent the governor a hemp bill that would loosen some restrictions, such as allowing more laboratories to test for THC. But the state’s industry is seeing setbacks, too; on Feb. 6, the state’s leading hemp company filed for Chapter 11 bankruptcy.

The Tennessee Department of Agriculture announced changes to the state’s hemp program last June. As a result, the industry has grown dramatically. The agency’s website notes that it “has licensed more than 2,900 hemp growers in 2019. In 2018, TDA approved 226 hemp producer applications.” By Nov. 1, 2019, the state had licensed 3,800 hemp farmers, according to Commercial Appeal.

In March 2019, Virginia legalized commercial hemp growing and processing, and in the fall, Gov. Ralph Northam announced the commonwealth’s first industrial hemp processing facility would be in Wythe County. The company will process bales of hemp stalks, and, according to the governor’s press release, “will sell bast fiber to a North Carolina company for further processing and sale to the textile industry, while the woody core of the plant, or hurd, will be sold to a Virginia company for use as animal bedding.”

© Michael M. Barrick, 2020.

Related Articles

Latest News

Leave a comment

Your email address will not be published. Required fields are marked *