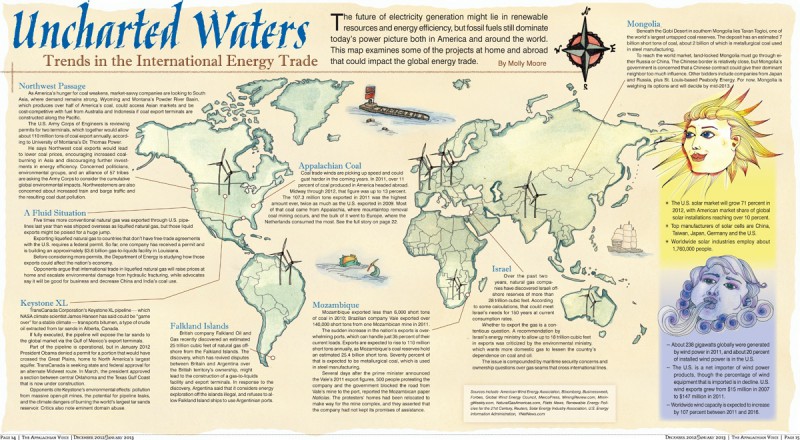

Uncharted Waters

Trends in the International Energy Trade

The future of electricity generation might lie in renewable resources and energy efficiency, but fossil fuels still dominate today’s power picture both in America and around the world. This map examines some of the projects at home and abroad that could impact the global energy trade. By Molly Moore

Northwest Passage

As America’s hunger for coal weakens, market-savvy companies are looking to South Asia, where demand remains strong. Wyoming and Montana’s Powder River Basin, which produces over half of America’s coal, could access Asian markets and be cost-competitive with fuel from Australia and Indonesia if coal export terminals are constructed along the Pacific.

The U.S. Army Corps of Engineers is reviewing permits for two terminals, which together would allow about 110 million tons of coal export annually, according to University of Montana’s Dr. Thomas Power.

He says Northwest coal exports would lead to lower coal prices, encouraging increased coal-burning in Asia and discouraging further investments in energy efficiency. Concerned politicians, environmental groups, and an alliance of 57 tribes are asking the Army Corps to consider the cumulative global environmental impacts. Northwesterners are also concerned about increased train and barge traffic and the resulting coal dust pollution.

Appalachian Coal

Coal trade winds are picking up speed and could gust harder in the coming years. In 2011, over 11 percent of coal produced in America headed abroad. Midway through 2012, that figure was up to 13 percent. The 107.3 million tons exported in 2011 was the highest amount ever, twice as much as the U.S. exported in 2009. Most of that coal came from Appalachia, where mountaintop removal coal mining occurs, and the bulk of it went to Europe, where the Netherlands consumed the most. See the full story in Coal Report.

A Fluid Situation

Five times more conventional natural gas was exported through U.S. pipelines last year than was shipped overseas as liquified natural gas, but those liquid exports might be poised for a huge jump.

Exporting liquefied natural gas to countries that don’t have free-trade agreements with the U.S. requires a federal permit. So far, one company has received a permit and is building an approximately $3.6 billion gas-to-liquids facility in Louisiana.

Before considering more permits, the Department of Energy is studying how those exports could affect the nation’s economy.

Opponents argue that international trade in liquefied natural gas will raise prices at home and escalate environmental damage from hydraulic fracturing, while advocates say it will be good for business and decrease China and India’s coal use.

Keystone XL

TransCanada Corporation’s Keystone XL pipeline — which NASA climate scientist James Hansen has said could be “game over” for a stable climate — transports bitumen, a type of crude oil extracted from tar sands in Alberta, Canada.

If fully executed, the pipeline will expose the tar sands to the global market via the Gulf of Mexico’s export terminals.

Part of the pipeline is operational, but in January 2012 President Obama denied a permit for a portion that would have crossed the Great Plains, home to North America’s largest aquifer. TransCanada is seeking state and federal approval for an alternate Midwest route. In March, the president approved a section between central Oklahoma and the Texas Gulf Coast that is now under construction.

Opponents cite Keystone’s environmental effects: pollution from massive open-pit mines, the potential for pipeline leaks, and the climate dangers of burning the world’s largest tar sands reservoir. Critics also note eminent domain abuse.

Falkland Islands

British company Falkland Oil and Gas recently discovered an estimated 25 trillion cubic feet of natural gas offshore from the Falkland Islands. The discovery, which has revived disputes between Britain and Argentina over the British territory’s ownership, might lead to the construction of a gas-to-liquids facility and export terminals. In response to the discovery,

Argentina said that it considers energy exploration off the islands illegal, and refuses to allow Falkland Island ships to use Argentinian ports.

Mozambique

Mozambique exported less than 6,000 short tons of coal in 2010; Brazilian company Vale exported over 140,000 short tons from one Mozambican mine in 2011.

The sudden increase in the nation’s exports is overwhelming ports, which can handle just 35 percent of their current loads.

Exports are expected to rise to 110 million short tons annually, as Mozambique’s coal reserves hold an estimated 25.4 billion short tons. Seventy percent of that is expected to be metallurgical coal, which is used in steel manufacturing.

Several days after the prime minister announced the Vale’s 2011 export figures, 500 people protesting the company and the government blocked the road from Vale’s mine to the port, reported the Mozambican paper Noticias. The protesters’ homes had been relocated to make way for the mine complex, and they asserted that the company had not kept its promises of assistance.

Israel

Over the past two years, natural gas companies have discovered Israeli offshore reserves of more than 28 trillion cubic feet. According to some calculations, that could meet Israel’s needs for 150 years at current consumption rates.

Whether to export the gas is a contentious question. A recommendation by Israel’s energy ministry to allow up to 18 trillion cubic feet in exports was criticized by the environmental ministry, which wants more domestic gas to lessen the country’s dependence on coal and oil.

The issue is compounded by maritime security concerns and ownership questions over gas seams that cross international lines.

Sources include: American Wind Energy Association, Bloomberg, Businessweek, Forbes, Global Wind Energy Council, MercoPress, MiningReview.com, MiningWeekly.com, NaturalGasAmericas.com, Platts News, Renewable Energy Policies for the 21st Century, Reuters, Solar Energy Industry Association, U.S. Energy Information Administration, YNetNews.com

Mongolia

Beneath the Gobi Desert in southern Mongolia lies Tavan Togloi, one of the world’s largest untapped coal reserves. The deposit has an estimated 7 billion short tons of coal, about 2 billion of which is metallurgical coal used in steel manufacturing.

To reach the world market, land-locked Mongolia must go through either Russia or China. The Chinese border is relatively close, but Mongolia’s government is concerned that a Chinese contract could give their dominant neighbor too much influence.

Other bidders include companies from Japan and Russia, plus St. Louis-based Peabody Energy. For now, Mongolia is weighing its options and will decide by mid-2013.

—————————————————

Solar

- ✴ The U.S. solar market will grow 71 percent in 2012, with American market share of global solar installations reaching over 10 percent.

- ✴ Top manufacturers of solar cells are China, Taiwan, Japan, Germany and the U.S.

- ✴ Worldwide solar industries employ about 1,760,000 people.

Wind

- ~ About 238 gigawatts globally were generated by wind power in 2011, and about 20 percent of installed wind power is in the U.S.

- ~ The U.S. is a net importer of wind power products, though the percentage of wind equipment that is imported is in decline. U.S. wind exports grew from $15 million in 2007 to $147 million in 2011.

- ~ Worldwide wind capacity is expected to increase by 107 percent between 2011 and 2016.