What Can the New Clean Energy Programs Do for You?

By Megan Pettey

It’s never been more cost-effective to switch to renewable energy or to make energy efficiency improvements. That’s true for rural power providers, businesses and homeowners — and now, for the first time, for tax-exempt entities like schools, churches, hospitals, local governments, nonprofit organizations, publicly owned utilities and rural electric cooperatives!

The Inflation Reduction Act of 2022 expanded existing clean energy programs and incentives, and created new ones. It also established a program that allows tax-exempt entities to take advantage of tax credits. The program acts like a rebate by allowing the federal government to directly refund the value of the tax credit that the institution would have paid if it paid taxes. For example, if a public library invests $125,000 to install a 50-kilowatt rooftop solar array, the library is eligible for $37,500 from the federal government to reflect the 30% solar investment tax credit.

Check out the summary below to see what opportunities are available for your community institutions and your home or business. Follow the links for more details about each program and tax credit.

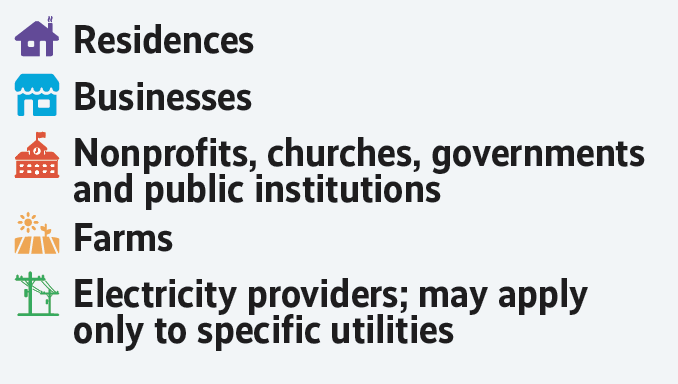

Legend

Use these icons to see you you might be able to benefit from these clean energy funding opportunities. The tax code is complicated, so find more eligibility information for each program in the links below.

Tax Credits

Residential Renewable Energy Tax Credit

Taxpayers can receive a credit of up to 30% of the costs of new clean energy systems installed between 2022 and 2032. This includes rooftop solar, battery storage, geothermal power and electric panel upgrades to accommodate new clean energy systems.

Learn more about the Residential Renewable Energy Tax Credit

Commercial-Scale Production Tax Credit & Investment Tax Credit

Businesses, nonprofits and governments installing solar, wind, geothermal and other technologies are eligible for the one-time 30% investment tax credit or the performance-based production tax credit at a rate of 2.75 cents per kilowatt-hour for the first 10 years of operation.

Learn more about the Commercial-Scale Production Tax Credit & Investment Tax Credit

Energy Community Tax Credit Bonus

Applies a 10% bonus for both production tax credits and investment tax credits for solar and other eligible energy projects and facilities located in qualifying energy communities. These communities may be eligible due to recently closed coal mines or coal-fired power plants, high levels of employment or tax revenue associated with fossil fuels, and other factors. Find a map of eligible places at EnergyCommunities.gov. This bonus can be added to other tax credits and bonuses.

Learn more about the Energy Community Tax Credit Bonus

Low-Income Communities Bonus Credit

Provides an additional 10-20% investment tax credit for small-scale solar and wind facilities on Indigenous land and in certain low-income communities. Solar and wind facilities with a maximum net output of less than 5 megawatts, including associated energy storage technology are eligible. This bonus can be added to other tax credits and bonuses, however it is limited to 1.8 gigawatts per year, and project owners must apply to the IRS to reserve capacity in the program, unlike other tax credit programs that are available to everyone who is eligible.

Learn more about the Low-Income Communities Bonus Credit

Domestic Content Bonus Credit

Provides a 10% bonus for projects where 100% of iron or steel is made in the U.S. and 40% of the cost of other components are made in the U.S. (with a changing rate for wind). This bonus can be added to other tax credits and bonuses.

Learn more about the Domestic Content Bonus Credit

Clean Vehicle Credit

- Individuals and businesses can receive a tax credit of up to $7,500 for purchasing a new, qualifying plug-in electric vehicle or fuel cell electric vehicle. Visit fueleconomy.gov for vehicle eligibility information.

- Taxpayers can also receive a credit of up to $4,000 for purchasing a used plug-in electric or fuel cell vehicle from a licensed dealer for $25,000 or less.

- Businesses and tax-exempt organizations can receive a tax credit of up to $40,000 for purchasing a commercial clean vehicle.

Learn more about the Clean Vehicle Credit

Energy Efficient Home Improvement Tax Credit

Taxpayers who make energy efficiency improvements to their home after Jan. 1, 2023 can claim a tax credit up to $3,200. The credit equals 30% of qualifying expenses including energy efficiency improvements, residential energy property expenses and home energy audits.

Learn more about the Energy Efficient Home Improvement Tax Credit

Grants & Loans

Empowering Rural America (New ERA) Program

- Who’s eligible? Rural electric cooperatives, wholly or jointly owned subsidiaries of rural electric cooperatives, existing or former USDA Rural Utilities Service borrowers, and borrowers of the former Rural Electrification Administration may apply.

- What’s the money for? Grants, loans and combinations of both can be used to make energy efficiency improvements, to purchase or build renewable energy, zero-emission systems or carbon capture storage systems. The program prioritizes reducing greenhouse gas emissions versus funding specific technologies.

- What’s the timeline? Letter of interest window runs July 31 through Aug. 31, 2023. A letter of interest can be submitted during that time, and invitations to submit an application will be sent after August 31.

Learn more about the New ERA program

Powering Affordable Clean Energy (PACE) Program

- Who’s eligible? Entities that generate electricity for resale may apply, including nonprofits, municipal utilities and electric cooperatives. At least 50% of the population served by the proposed project must live in communities with populations of 20,000 or less.

- What’s the money for? Loans can be used to fund wind, solar, hydropower, geothermal or biomass renewable energy projects. Loans are up to 60% forgivable based on the project.

- What’s the timeline? The letter of interest window will close on Sept.29, 2023. A letter of interest is required, and after letters of interest are reviewed, applicants will be invited to submit a full application.

Learn more about the PACE program

Rural Energy for America Program (REAP)

- Who’s eligible? Rural small businesses and agricultural producers may apply.

- What’s the money for? Grant funding and loan financing can be used to purchase renewable energy systems or to buy, build or install energy efficiency improvements.

- What’s the timeline? Applications are accepted all year and evaluated quarterly. The next quarter ends Sept. 30, 2023.

Learn more about the REAP program

Coming Soon…

For two programs, funding will be made available to states in the summer of 2023 and rebates are expected to become available to homeowners after in late 2023 or early 2024. Contact your state energy office to learn more.

High-Efficiency Electric Home Rebate Program (HEERA)

Based on income, participating homes can receive up to $14,000 in rebates with individual caps of:

- $8,000 for heat pumps used for heating, ventilation and air conditioning

- $1,750 for a heat pump water heater

- $840 for an electric stove or electric heat pump clothes dryer

- $4,000 for an electric panel upgrade

- $2,500 for wiring

- $1,600 for insulation, air sealing and ventilation

Learn more about the HEERA program

Home Owner Managing Energy Savings Rebate Program (HOMES)

Establishes rebate programs for residential efficiency retrofit projects to support whole-house efficiency retrofits, with rebates determined by estimated energy savings.