Pipe Dreams: The push to expand natural gas infrastructure

By Brian Sewell

The vast network of natural gas pipelines that traverses the United States is a spiderweb of steel — more than 300,000 miles of it — and it’s growing larger every year.

Over the past decade, fracking in Appalachia has unlocked an abundance of low-cost natural gas, transforming America’s energy mix and creating the present-day push to expand a regional network of natural gas pipelines and other infrastructure. Courtesy of Terry Wild Stock Photography.

Over the past decade, natural gas has been the dominant force cutting into coal’s share of America’s electricity mix. Between 2007 and 2013, coal-fired electricity declined from nearly half of nationwide power generation to 39 percent, while natural gas’s share grew from 22 percent to 27 percent. In the first six months of 2014, gas-fired power plants comprised more than half of the 4,350 megawatts of new utility-scale generation. Renewable energy made up the rest.

Nowhere has the pivot toward natural gas been more pronounced than in the eastern United States. Fracking in northern Appalachia has boosted production at a breakneck pace, and electric utilities’ growing preference for gas over coal is reshaping the relationship between energy-producing Appalachian states and their East Coast customers.

That historic transformation also created the present-day rush to expand the region’s natural gas infrastructure, including pipelines and compressor stations, at a scale and speed proportional to the drilling boom.

Pipeline developers and electric utilities tout natural gas as a “bridge fuel” guiding the way to a future built on renewable energy, and argue that more pipeline capacity is necessary if states are to comply with federal regulations on carbon pollution in the near term.

But landowners whose property lies along a pipeline route worry about local impacts, while others warn of the long-term consequences — to Appalachian communities, energy consumers and the climate — that could come with a reliance on this fickle fuel.

Parsing the Pipelines

Natural gas has traditionally flowed through pipelines from south to north, bringing the fuel from Gulf states to markets along the East Coast.

Consider the Transcontinental Pipeline. The largest-volume system in the country, the Transco Pipeline has a capacity of 10 billion cubic feet a day, runs more than 10,000 miles through a dozen states, and supplies gas-fired power plants operated by Duke Energy and Dominion Resources, among other electric utilities along its route.

Fracking in northern Appalachia, however, has boosted production to the point that Williams Partners, the operator of the Transco Pipeline system, announced plans in March 2014 to make the system bi-directional. The $2.1 billion Atlantic Sunrise Project would add 1.7 billion cubic feet per day of capacity by expanding existing pipelines in Pennsylvania and modifying compressor stations in mid-Atlantic states, including Virginia and North Carolina, to facilitate the flow of Marcellus gas southward.

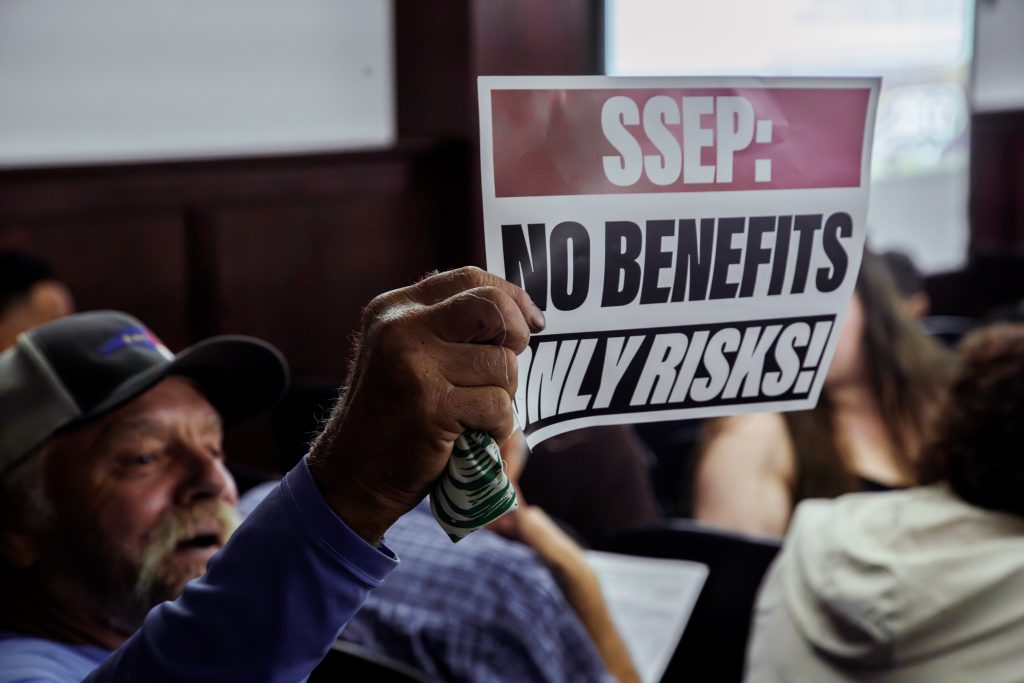

A local landowner and a Dominion representative discuss the Atlantic Coast Pipeline’s proposed route at a public hearing held in Nelson County by the Federal Energy Regulatory Commission. Photo by Will Solis, willsolisphotography.com.

The decision by Williams Partners is part of a larger trend to reverse pipeline flows in response to shifting supplies. According to the U.S. Energy Information Administration, 32 percent of pipeline capacity into the Northeast could be bi-directional by 2017. And other energy companies hope to take advantage of Transco’s reach by connecting new pipelines with the expansive system.

The Mountain Valley Pipeline, a joint venture of NextEra Energy and EQT, a fracking company operating in the Appalachian Basin, would originate in Wetzel County, W.Va., and course 330 miles through more than a dozen other counties and the Jefferson National Forest before connecting with a Transco compressor station in Pittsylvania County, Va. In both states, the proposal has caused vehement backlash that has erupted into legal battles.

In March, a group of West Virginia landowners who have resisted efforts by the pipeline’s developers to survey their property filed suit against the companies. Attorneys with the group Appalachian Mountain Advocates, which is representing the landowners, argue that the power of eminent domain can only be exercised in West Virginia if a project has “public use.”

But plans for the Mountain Valley Pipeline do not include any delivery points in West Virginia, where distribution companies could collect gas that would be sold locally. As a result, Derek Teaney of Appalachian Mountain Advocates argued, “not a single West Virginian will have access to, or otherwise use, gas carried by the pipeline.”

The lawsuit follows threats by the pipeline’s developers that “legal action will likely be taken in order to obtain the necessary access” to survey private land along the Mountain Valley Pipeline route. Across Appalachia, stories of citizen resistance are becoming commonplace in communities along a pipeline’s path.

An even larger proposed pipeline would originate in Harrison County, W.Va., not far from the Mountain Valley Pipeline’s beginning, and stretch 550 miles across West Virginia, central Virginia and the North Carolina Piedmont.

Dominion Resources’ $5 billion plan to build the project, known as the Atlantic Coast Pipeline, was selected last year by Duke Energy and Piedmont Natural Gas, which solicited proposals to build a pipeline that provides “geographical diversity” compared to existing pipelines and allows for “future low-cost expansions with minimal environmental impact.” Duke Energy would share ownership of the pipeline and be one of its largest customers, having opened five natural gas-fired power plants in North Carolina since 2011 to replace shuttered coal-fired capacity.

The Atlantic Coast Pipeline’s route crosses several areas of ecological concern, such as the Monongahela and George Washington national forests, the Appalachian Trail and the Blue Ridge Parkway. To minimize the environmental impacts, Ernie Reed, president of the conservation group Wild Virginia, says companies should prioritize using existing right-of-ways.

“If you want to get more automobiles from Front Royal to Roanoke, you build another lane on the existing interstate,” says Reed. “You don’t build another eight-lane interstate that connects those two areas.” Dominion says it prefers to use existing rights of way where possible, but “oftentimes it is not feasible.”

Reed is a former resident of Nelson County, Va., where, by Dominion’s own admission, the groundswell of grassroots opposition the company has faced is stronger than anywhere else along the pipeline’s proposed route. On March 10, the county’s board of supervisors approved a resolution asking Dominion and the Federal Energy Regulatory Commission to respect landowners and carefully consider alternative routes.

According to the resolution, “Dominion has taken no action to minimize eminent domain takings in Nelson County by proposing a route using existing rights of way.”

Together, the Mountain Valley and Atlantic Coast pipelines would carry 3.5 billion cubic feet of natural gas a day from fracking operations in Appalachia to power plants, distribution companies and industrial users in the Southeast. Both are planned to begin operations by late 2018.

Regulating the Risk

As public opposition grows, so does frustration with the Federal Energy Regulatory Commission, the agency responsible for regulating electricity markets and other interstate energy commerce.

“I think that our nation is going to have to grapple with our acceptance of gas generation and gas pipelines if we expect to achieve our climate and environmental goals,” FERC chair Cheryl LaFleur told an audience at the National Press Club in January.

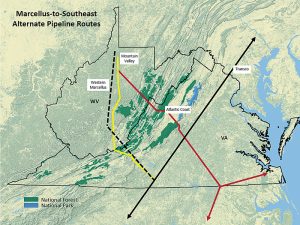

Proposed natural gas pipelines would expand the fuel’s availability to southeastern electric utilities, but some concerned citizens want developers to better utilize existing pipeline capacity. Map created by Rick Webb for Appalachian Mountain Advocates.

Worried about the type of investments being prioritized, a coalition of environmental and citizens group in Appalachia announced this month that they are aligning their efforts to challenge FERC. The groups, including Wild Virginia, Ohio Valley Environmental Coalition, FreshWater Accountability Project and Allegheny Defense Project, contend that FERC’s push to increase natural gas infrastructure “incentivizes fracking while stifling the development of renewable energy,” and that the agency is approving pipeline projects without first proving they are in the public interest.

“Part of that determination requires considering effects to the environment and communities, and there clearly are many,” Terry Lodge, an attorney representing FreshWater Accountability Project, said in a joint press statement. If FERC has already determined up front that the public is “just going to have to accept more pipelines,” according to Lodge, “it can’t be trusted to rigorously evaluate those effects.”

A February report by the U.S. Department of Energy emphasized that fully utilizing or rerouting existing interstate pipelines could provide “lower-cost alternatives to building new infrastructure and can accommodate a significant increase in natural gas flows.”

FERC recently completed a series of public hearings on the Atlantic Coast Pipeline in North Carolina and Virginia. Local groups, including Friends of Nelson, asked residents to contact FERC requesting an extension of the public

comment period since, at least at one hearing, fewer than half of the people who signed up to speak were given the chance. Dominion urged FERC to stay the course. Public hearings on the Mountain Valley Pipeline were held in early April.

Once pipelines begin operation, new, sometimes catastrophic, risks emerge.

This past January, the ATEX Express ethane pipeline, used to transport the second-largest chemical component of natural gas, exploded in Brooke County, W.Va., just a year after beginning commercial operation. An explosion along I-77 near Sissonville, W.Va., in December 2012 charred 800 feet of the highway. And in 2008, the Transco pipeline ruptured in Appomattox County, Va., igniting a fireball that melted the siding on homes 400 yards away. In that case, investigators fined Williams Partners $952,000, citing failures by the company to meet monitoring requirements and prevent external corrosion.

The Pipeline and Hazardous Materials Safety Administration maintains that pipelines are “the safest, most environmentally friendly and most efficient and reliable” way to transport natural gas. But, the agency points out, “accidents still happen, sometimes with tragic consequences.”

Fueling the Future

With a typical lifespan of up to 100 years, natural gas pipelines are by definition long-term investments.

So, what does a more natural gas-reliant future look like? For millions of residents in the Northeast, it may look a lot like today. Around 44 percent of the region’s generation capacity came from natural gas last year, a sharp increase from 15 percent in 2000. During that same period, coal’s share of generation plummeted, but renewables only grew by 1 percent.

Investments in gas-fired generation have unsurprisingly been based on easy access to an abundant supply of natural gas in the nearby Marcellus Shale. But ratepayers have felt the sting of spiking gas prices, particularly during winter months when demand is highest, and a pipeline outage at any time of year would impact thousands of megawatts of generation.

The short-term solution is to push for more pipeline capacity, but that logic quickly becomes problematic and could create the type of energy trap that is the subject of “The Natural Gas Gamble,” a report by the science advocacy organization Union of Concerned Scientists.

While acknowledging the near-term benefits of burning natural gas instead of coal, the report warns that becoming too reliant on natural gas poses complex risks, including persistent price volatility and the problems associated with a changing climate. The analysis suggests the only way to bet on natural gas, and win, is to greatly expand adoption of renewable energy and energy efficiency in the nation’s power supply.

“For its part, natural gas could still play a useful — but more limited — role in the transition to a clean energy system, not as a replacement for coal but rather as an enabler of grid flexibility in support of renewable technologies,” Jeff Deyette, one of the report’s authors, wrote on the group’s blog.

Researchers also point out that betting big on natural gas now could lead to unnecessary investment in pipelines and other expensive, long-lived infrastructure that would become stranded assets as utilities face the inevitable need to shift to truly clean energy sources.

Some see natural gas as the preordained king of America’s energy future. But responsibly balancing a reliance on the so-called “bridge fuel” looks more and more like a tightrope walk, where each step comes with considerable risk.

Related Articles

Latest News

More Stories

Leave a comment

Your email address will not be published. Required fields are marked *

Leave a Comment