How the Coal Mine Cleanup System is Failing

When coal companies fail to reclaim their surface mines, like the Aily Branch Mine pictured here in Buchanan County, Va., they leave vast areas of disturbed ground. Surface mining destroys natural creeks and drainage systems in addition to vegetation. This poses an increased safety hazard to area residents during heavy rain because of excessive stormwater runoff. Photo by Willie Dodson.

By Dan Radmacher and Willie Dodson

Editor’s note: This story provides an update to Blackjewel’s Catastrophic Bankruptcy and the Collapse of the Mine Cleanup System, a story that first appeared in The Appalachian Voice in March 2022. The print version of this story was published on July 29, 2022, and was updated on September 1 to reflect new information provided by regulators after inspections of the Aily Branch Mine.

The bankruptcy of Blackjewel, LLC, and its affiliates was, on its own, a very momentous event in the coal industry.

Once the sixth-largest coal producer in the nation, Blackjewel sent shockwaves through the industry and through coal communities from Virginia to Wyoming when it filed an early-morning emergency petition in July 2019 that kicked off the bankruptcy process, suddenly laying off about 1,700 workers and clawing back paychecks from some employees’ bank accounts.

But as stunning as the Blackjewel bankruptcy was, the flaws it has exposed in the mine cleanup system may have even more profound implications.

“Blackjewel is significant for itself,” Sierra Club attorney Peter Morgan says. “It involved lots of permits. It affects lots of people. But its greatest significance is the way it illustrates how the [federal] regulatory program is totally broken and unprepared to deal with the state of decline of the coal industry.

“Blackjewel is not going to be an isolated incident,” Morgan says, “It is not an outlier, it is a bellwether.”

A Failing System

When Blackjewel, its affiliate Revelation Energy and other related companies declared bankruptcy in July 2019, the mines shut down immediately and didn’t continue to operate during the proceedings, which was unusual. The bankruptcy also left the fate of thousands of acres of scarred and polluting land up in the air.

Fixing land damaged by surface mining is known as mine reclamation. This includes revegetating the land and taking other steps to restore the site, minimize the pollution it generates and prevent hazards like landslides and retention pond failures.

Under the U.S. Surface Mining Control and Reclamation Act, companies are supposed to reclaim the land as much as possible while mining is still ongoing.

If a coal company that mines a site can’t clean it up, federal law requires the state mining agency to ensure reclamation is completed. States fund mine clean-up through a bonding program where money is often provided by a third-party company, known as a surety. Surety companies essentially provide reclamation insurance to coal companies, guaranteeing payment of reclamation costs in exchange for fees paid by the coal company. When working with a surety company, coal companies will post a bond before the state issues a mining permit which gives the state that assurance as collateral.

If the coal company walks away and cleanup falls to the state, the state agency is supposed to be able to reclaim the site using the coal company’s forfeited bond or by using money from a state bonding pool that multiple companies have contributed to.

But with the number of coal company bankruptcies rising, the system is under increasing stress, and it still isn’t clear who will pay to clean up the 200 or so mining sites abandoned in the Blackjewel bankruptcy. In some cases, the bond amounts set by the state may be insufficient for the actual cost of reclamation. If many companies forfeit their mines, even state pool bonds and sureties may be unable to cover the total costs.

“If sufficient bonds aren’t available, it is likely that many of these sites will not be reclaimed,” says Erin Savage, senior program manager at Appalachian Voices, the nonprofit organization that publishes The Appalachian Voice. “As the sites decline, pollution and safety issues will increase. The costs created by these mines will fall on nearby community members and taxpayers across the impacted states, unless state or federal programs are created to provide backup funding.”

Who’s Responsible?

At the mine sites that Blackjewel and its affiliates left behind, reclamation should fall to the state and be funded by the coal companies’ forfeited bonds and a portion of the state bond pool, according to Morgan.

But in some cases it is not clear if the permit transfers can be completed.

“If a landslide happens on that permit, who’s responsible?” asks Mary Cromer, deputy director of Appalachian Citizens’ Law Center, a nonprofit law firm in Eastern Kentucky focused on coal-related issues. “The state hasn’t taken over responsibility. The surety hasn’t taken over responsibility. Who’s responsible for daily maintenance to keep these sites safe and monitor pollution?”

According to John Mura, executive director for the Office of Communication at the Kentucky Energy and Environment Cabinet, state regulations allow for the purchasers of permits to be treated as the owners responsible for violations even before the permits have been transferred.

Cromer and Morgan maintain that federal law imposes an obligation on the cabinet to ensure prompt and complete reclamation of these sites, and that the cabinet has failed to take the actions necessary to satisfy that obligation.

But even when responsibility is clear, regulators haven’t done a good job of holding mining companies accountable — which, for Blackjewel mines, has made the current situation even worse.

According to Morgan, states like Kentucky have hesitated for years to strictly enforce reclamation regulations or ensure coal companies put up adequate bonding out of fear the costs might force the companies into bankruptcy and leave the state holding the bag. But that pushes the consequences onto the communities near these sites.

“We disagree,” Mura says. “The Energy and Environment Cabinet appropriately enforced [federal law], while taking into account the importance of jobs in the coalfields.”

Downstream Consequences

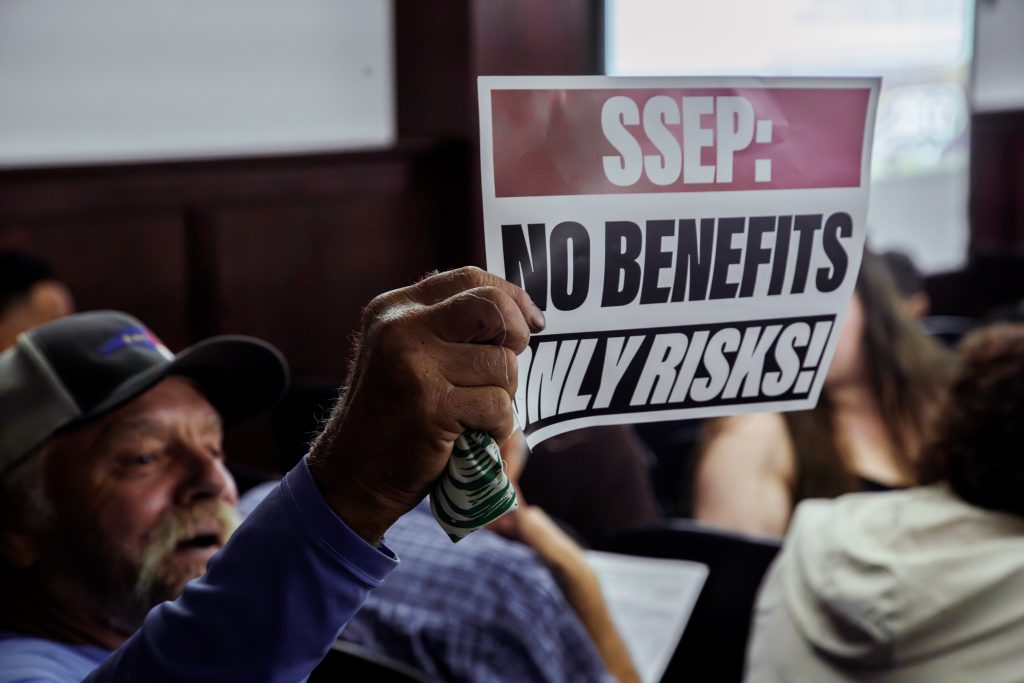

Bobby Mitchell lives downhill from the Aily Branch Mine in eastern Buchanan County, Virginia. He and his family experience the consequences of the sluggish reclamation firsthand. Rainwater picks up mud and debris from the mine site, which drains into the creek running between his home and the road.

Bobby Mitchell lives below the unreclaimed Aily Branch Mine. This building on his property was damaged during the July 2022 flood, and was in the path of runoff from the mine in addition to the flooded Dismal Creek. Photo by Willie Dodson.

Blackjewel owned this mine, but it was one of many mines that didn’t find a new owner prior to completion of bankruptcy proceedings. Finally, in November 2020, a small Kentucky company, Civil, LLC, acquired the mining permit.

Residents near the Aily Branch Mine, including Mitchell, reported problems for several years before the bankruptcy, and the problems haven’t gone away since Civil took over. In fact, during Civil’s tenure, Aily Branch and two adjoining mines have continued to rack up violations for failing to meet reclamation standards, and the company has had to pay nearly $100,000 in fines over the past year as a consequence of enforcement actions by the Virginia Department of Energy.

“I’m worried about those holding ponds up there,” Mitchell said in a February 2022 interview with The Appalachian Voice, referencing the sediment ditches that line the perimeter of most mountaintop removal mines. “I’m afraid they’re going to overflow like they did in the past. I’m concerned for my family’s safety.”

The berms holding up those sediment ditches have failed before, sending logs and large rocks hurtling onto Mitchell’s land. In July 2022, a heavy rainfall hit his area, and again a torrent of water, mud and debris poured down the mountainside, dumping rocks, trees and mud onto Mitchell’s property, as well as that of his son and brother. The flash flood left a wide swath of mud along the mountainside where a small stream used to flow.

State regulators conducted several inspections following the flood, and an Appalachian Voices representative joined for one. The inspector determined that Aily Branch’s sediment control structures had not breached, as Mitchell fears will someday happen. Instead, a large portion of the downslope area immediately below one of the ponds had become saturated and destabilized, causing the slide. The slide occurred within the mine permit boundary, but, regulators determined that it occurred in an area that was undisturbed by mining activity, and thus that no violation had occurred.

Mitchell still believes that the unreclaimed mine — in addition to the presence of a network of gas wells and access roads — made the impacts of the heavy rainfall much worse for his family.

“There was as much water coming down [from the mine as there was in the creek,” Mitchell says. “It took out this building my dad built, and washed away our push mower, a bunch of tools, and two or three thousand dollars worth of lumber. That building would have probably been gone if it hadn’t slammed up against a tree that held it there.”

A few weeks before the flood, the Virginia Department of Energy had signed a compliance agreement with Civil, granting the company extra time to complete the already overdue reclamation.

Ownership Changes, But Cleanup Still Lags

In October 2020, the West Virginia Department of Environmental Protection revoked three Revelation Energy mine permits near Kanawha State Forest. Revelation, a Blackjewel affiliate, had made no progress in transferring the permits to other companies following its bankruptcy, and the mines had years of chronic water pollution and safety issues both under Revelation and a previous owner, Tom Scholl.

But one year later, the DEP attempted to reinstate those permits in order to transfer them back to Tom Scholl, who this time assumed the mines under the banner of Keystone West Virginia, LLC. This new enterprise is distinct on paper from Scholl’s other company, Keystone Development, which has a long history of violations — including from when it previously held these same permits before transferring them to Revelation in 2013.

The Clean Water Act permits for two of the three mines expired in 2020 and were not renewed. Now, Keystone West Virginia appears to be discharging wastewater without appropriate permits, and given the long history of pollution, it is likely the company is continuing to violate pollution limits as well.

Through Keystone Development, Scholl’s storied history of noncompliance also includes years of ongoing violations on the adjacent KD2 mine. The DEP forced KD2 to cease coal mining ahead of schedule and — after a successful campaign by Kanawha Forest Coalition to expose the mine’s impacts — required the company to begin reclamation in 2016.

But little cleanup has actually happened, members of the coalition say.

“Companies know they can shirk responsibilities for cleaning up these sites for as long as they can get away with it or until they’re ready to throw in the towel,” says Chad Cordell, one of the founders of the coalition. “Clearly, the whole system is a failure and is at or approaching a breaking point. It is a mess.”

“It Just Doesn’t Make Sense Anymore”

“What’s happening highlights a weakness in the way that [the U.S. Surface Mining Control and Reclamation Act] was written,” Morgan says. “It’s become very clear that one of the fundamental premises of the SMCRA regulatory structure is that there will always be a coal mining industry, that there will be new permits issued and new mines opening. The structure relies on that promise of new money coming into the system. It’s not prepared to deal with a situation where no new money is coming in and a rapidly increasing number of permits are being abandoned.”

In such a situation, each new mine permit is a future risk, according to Morgan.

Some members of Congress have recently introduced legislation that could help reverse the collapse of this system.

U.S. Rep. Conor Lamb, (D-Pa.), introduced a bill in June that would provide states with money for grants from the U.S. Office of Surface Mining, Reclamation and Enforcement to cover reclamation deficits at mine sites where bonds have been forfeited — but only if those states show they are shoring up their bonding programs and have made attempts to recover additional money from the responsible coal companies.

Another bill, the Coal Cleanup Taxpayer Protection Act sponsored by U.S. Rep. Matt Cartwright (D-Pa.), would require states using bond pools and other alternative bonding systems to show that the programs are financially sound based on a five-year forecast of market conditions, anticipated forfeitures and reclamation costs. The bill would also require companies to replace existing self-bonds with more concrete financial assurances. Both of these bills are supported by Appalachian Voices, the group that publishes The Appalachian Voice.

Adjustments to the current system are badly needed, according to Morgan. “In the meantime, industry and regulators have made the mess, but communities are bearing the burden and living with the impacts,” he says.

Related Articles

Latest News

More Stories

Leave a comment

Your email address will not be published. Required fields are marked *

Leave a Comment