Gov. Jim Justice’s Barren Mine Lands and Unpaid Taxes

By Kevin Ridder and Matt Hepler

Coal companies owned by the family of West Virginia Gov. Jim Justice, pictured in front of the state Capitol building at the 2017 Oil and Gas Workers Rally, owe more than $3.7 million in back taxes across 10 counties in three states. Public domain photo

Coal baron and West Virginia Gov. Jim Justice reaped coal from Central Appalachia for decades to become the wealthiest person in the Mountain State with a current net worth of $1.5 billion.

But as the coal industry has stagnated in recent years, Justice and his son Jay Justice — who inherited a number of coal companies from his father in 2017 — have shown time and time again that the Justice family is loath to pay their coal companies’ taxes and mine land reclamation costs.

Under the federal surface mining law and corresponding state regulations, mining companies are required to post a bond to cover future costs of restoring the mine site’s terrain, soil, vegetation and streams close to their original condition.

But this is much easier said than done. When coal was king, many states allowed mining companies to build up a backlog of unmet mine reclamation responsibilities instead of enforcing prompt cleanup. Now that many mine lands sit barren and inactive, getting often-bankrupt coal companies to restore Appalachia’s moonscapes is akin to pulling teeth.

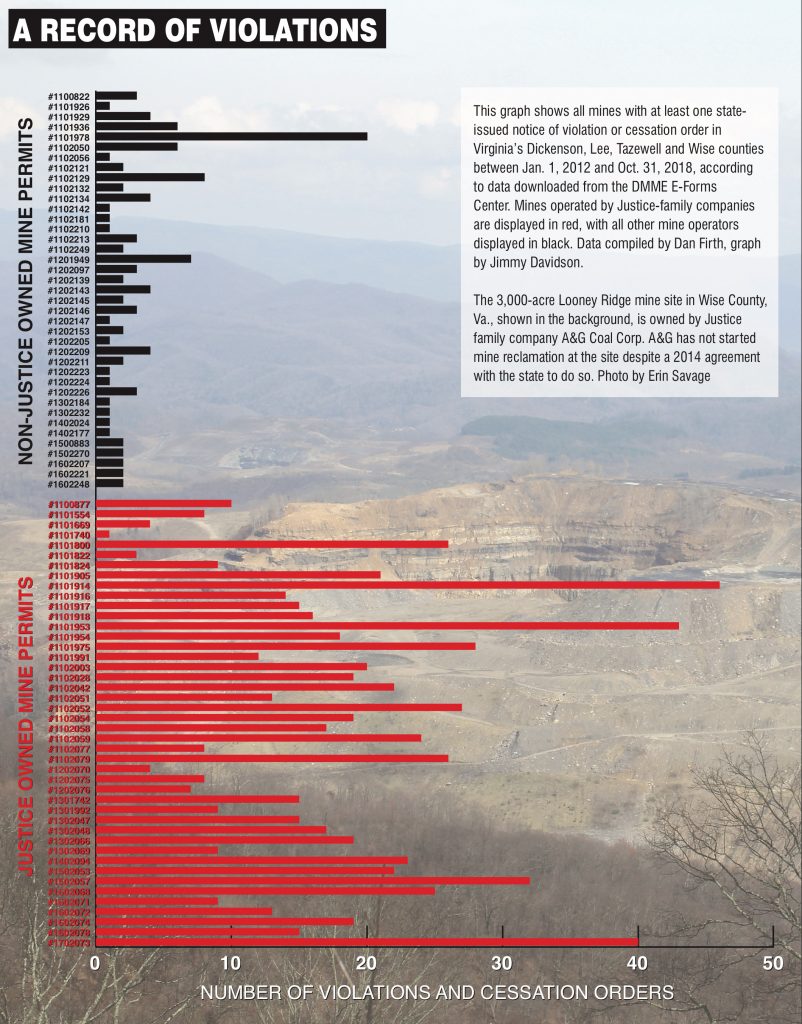

The 3,000-acre Looney Ridge mine site in Wise County, Va., is owned by Justice family company A&G Coal Corp. A&G has not started mine reclamation at the site despite a 2014 agreement with the state to do so. Photo by Erin Savage

Before Justice took the governor’s seat, he resigned as an officer or director of all his companies, Justice attorney Brian Helmick told the Charleston Gazette-Mail in March 2017. Justice gave control of the historic Greenbrier resort to his daughter Jill and named his son, Jay, overseer of the Justice coal and agriculture companies. Although Jim Justice has said that he would put his companies in a blind trust while governor, he had not done so for all of them as of Jan. 3.

In Virginia alone, Justice family-owned companies have accumulated $195 million in unaddressed mine cleanup costs, according to the state’s Department of Mines, Minerals and Energy. Approximately $135 million of that is attributable to Justice-owned A&G Coal Corp. In Alabama, Kentucky and West Virginia, Justice companies would owe more than $71.8 million in mine reclamation costs if they went bankrupt, according to data compiled by Mark Olalde with Climate Home News in March 2018.

Justice family-owned companies also have a history of failing to pay property and mineral taxes for their mines on time, and sometimes at all. When Jim Justice took the West Virginia governor’s office in 2017, his companies owed more than $4 million in back taxes spread across the state. Justice has said multiple times that some of his companies with delinquent taxes could have declared bankruptcy, but they opted not to because bankruptcy would have hurt rural counties and left mine sites unreclaimed.

In August 2018, Justice announced that he had paid all taxes and related fines in West Virginia. However, the question of millions of dollars in unpaid taxes owed to other states was left up in the air.

A 2016 National Public Radio investigation revealed that Justice companies owed nearly $5.4 million in unpaid taxes across 12 Tennessee, Alabama, Virginia and Kentucky counties. The Appalachian Voice followed up with these counties in January 2019 and found that the companies still owe more than $3.7 million in combined taxes from as far back as 2013 in 10 Tennessee, Virginia and Kentucky counties. Two Alabama counties did not return requests for comment.

Justice family-owned Kentucky Fuel Corp. currently owes more than $125,000 to the Magoffin County, Ky., government. To collect unpaid taxes, the county accepted payments from the company through a monthly payment plan — but payments suddenly stopped after a year, without explanation, in September 2017.

The Justice companies’ failure to make good on tax payments from years past has hurt many rural localities. According to the Lexington Herald-Leader, in February 2018 the Knott County school district projected layoffs due to a $100,000 budget shortfall. The district would have received more than $1 million from Kentucky Fuel if the company had paid the approximately $2 million in delinquent taxes it owes the Knott County government.

Kentucky Rep. John Blanton told The Morehead News in February 2018 that without help from the state, the Knott County School District would have to shut down in April 2018. The state gave the school district $1.2 million in the spring of 2018 to avoid layoffs, according to Knott County Schools Finance Officer Greg Conn.

Later that year, then-Knott County Judge-Executive Zach Weinberg passed a summary judgment against Kentucky Fuel, ordering the company to pay its remaining taxes. While this technically means that the company is required by law to pay the county, Weinberg remarks that, “it doesn’t seem like it has much teeth to it.”

Weinberg says he pushed for the county sheriff to seize the company’s property, but that “they’ve chosen not to do that for whatever reason. He’s paid in the past, and it’s a lot easier just to get him to pay.”

In Tazewell County, Va., County Treasurer David Larimer took a more aggressive stance toward Justice-owned Black River Coal’s delinquent tax bill of more than $800,000. Although the company entered into a payment plan with the county in November 2017, payments soon ceased, with no explanation, as they had in the past. So after Black River Coal ignored several notices, Larimer and the county sheriff’s office seized mining equipment to cover the majority of the balance in May 2018. The remaining amount, roughly $158,000, is being contested in court.

“We were able to avert a real bad, difficult situation for the county,” Larimer says. If the county had been unable to recover the Justice company’s delinquent taxes before the fiscal year ended in June 2018, the school district and other county departments would have faced a budget shortfall. He states that the only other option would have been to take the company to court.

Larimer could face a similar situation this year. The Justice family-owned company again missed the Dec. 5 tax deadline, and owed more than $320,000 to Tazewell County as of press time in late January.

“We’d certainly be glad to work with him on getting a payment plan or working on getting it paid,” says Larimer, noting that the company has yet to contact the county. In Tazewell County, he states, it’s unusual for a coal company to miss tax payments.

“Most of them pay their taxes on time,” Larimer says. “They’re the only ones we’ve had these issues with.”

Virginia Fund in Danger

In Virginia, Justice-owned companies have racked up numerous violations for water quality damages, safety hazards and other problems on multiple sites and have continuously delayed reclaiming several mines. The state might not have the tools to hold them accountable.

The Virginia Department of Mines, Minerals and Energy is responsible for ensuring that land mined for coal is reclaimed to acceptable environmental standards. As the coal industry has declined, reclamation of mines has become less certain.

Normally, mining companies are required to post a bond to cover future reclamation costs before the company can begin mining. But in Virginia, some coal companies pay a portion of the money it would take to reclaim their sites into a centralized state fund called a “pool bond” rather than posting a bond for the full cost of reclamation. The risk of any one company reneging on its commitment to clean up the mine site is theoretically offset by the other companies also paying into the fund.

A 2012 review of the fund conducted by a contractor hired by the state found that the pool bond would not be sufficient if one of the larger companies were to go bankrupt. Using Alpha Natural Resources as a test scenario, the study found that the Virginia pool bond would go bankrupt within five years if Alpha went under.

Combined, the amount of money in the bonds posted by Justice family-owned companies is only marginally smaller than Alpha’s share. Partially following the recommendations made in the review, the Virginia legislature raised the cap on the combined funds allowed in the pool bond from $2 million to $20 million in 2014 — although the review actually recommended eliminating the cap entirely.

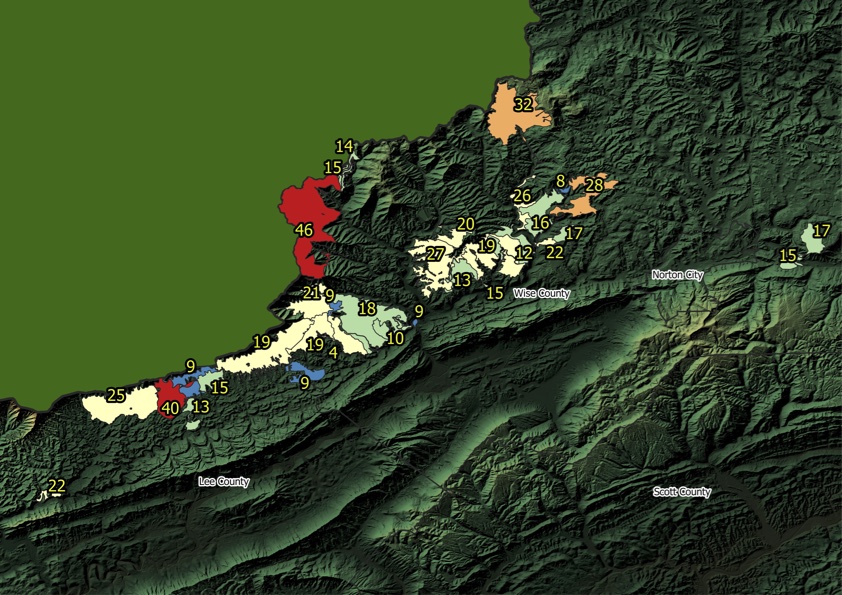

This map outlines the combined number of violations and cessation orders for mines in Wise and Lee counties owned by Jim Justice. Map by Dan Firth

It remains to be seen if such actions were enough to protect Virginia’s pool bond. The cost to reclaim the mines owned by just one of the Justices’ Virginia companies, A&G Coal Corp., is $135 million — nearly 15 times the pool bond’s January 2019 value of approximately $9.2 million. Meeting minutes from the 2017 meeting of the Coal Surface Mine Reclamation Fund Advisory Board identify the Justice companies as the single largest threat to the pool bond.

Additionally, A&G is the only coal company in Virginia that still employs self-bonding, a practice in which the company does not post a bond and instead only has to prove that they are financially capable of covering all reclamation costs at the time the mine is permitted. If a company with self-bonded mines goes bankrupt, taxpayers could be fully responsible for the cleanup costs. Virginia no longer allows the practice of self-bonding for new mines.

“I think it’s a dire situation,” says Taysha DeVaughan, president of the Southwest Virginia environmental nonprofit organization Southern Appalachian Mountain Stewards.

“If [Virginia regulators] go after him in any way and they have to default, and the state has to pick up the burden for that, then it’s going to be the taxpayers that have to pay that back.”

Putting Off the Problem

According to Virginia mining regulations, the DMME only has a few tools at its disposal to deal with bond forfeiture, which is when a coal company walks away from its commitment to clean up a mine site and surrenders the money in its bond.

One option for the agency is to go through bond forfeiture proceedings. When the cost of reclamation exceeds the money available in the bond, the DMME can require the company to cover the remaining cost. However, there is often not an effective way for the state to collect this money, especially if a company has declared bankruptcy.

Another option for the agency is to negotiate a compliance agreement with the company, where the company agrees to fix current problems and resolve future ones or face penalties.

In 2014, the DMME entered into its first compliance agreement with seven Justice companies, which addressed four potential bond forfeitures as well as numerous violations on a total of 36 permits. Since then, the agency has had to modify the compliance agreement four separate times to account for new violations as well as failures to comply with the previous agreement, each time aiming to help the Justice family companies avoid bond forfeiture.

Despite these efforts, four mines in Wise County, Va., almost went into bond forfeiture in 2017 and were spared through yet another compliance agreement signed in August 2018. Justice companies still have not finished addressing the reclamation issues at a mine on Looney Ridge in Wise County, Va., included in the original 2014 agreement.

Co-author Matt Hepler, left, and Southern Appalachian Mountain Stewards President Taysha DeVaughan, right, before conducting water testing by a coal mine near Norton, Va. Photo courtesy of Taysha DeVaughan.

“I don’t think that [these compliance agreements] are very effective at all, for the simple fact that when they do make compliance agreements, he doesn’t normally pay what he’s supposed to pay for those, and then he usually comes into violation in some other way with that agreement,” says DeVaughan. “Instead of enforcing that agreement, they will do another one.”

According to DeVaughan, if Virginia regulators held the companies fully accountable to the compliance agreements, the companies would likely have to go bankrupt — shifting the burden to taxpayers.

“In my personal opinion, that’s why they may not push him as hard, because they don’t have the funds and they don’t have a tactic on what they’re going to do once that happens,” says DeVaughan.

There is another option, however. The regulations seem to state that the DMME could go after the Justices’ personal assets if bond funds are insufficient, though that has not been tested in practice. The state would likely have to empty the pool bond before they could go after the family’s other assets.

A Widespread Problem

The Justice family’s reclamation problems aren’t limited to Virginia. Their mines have a history of non-compliance across the region, and many of their companies are in the habit of not paying their bills. In August 2018, a federal judge authorized federal marshals to collect any kind of possessions from three of the family’s companies in West Virginia to pay a $1 million judgment owed to a company that won a lawsuit against the family, according to the Charleston Gazette-Mail.

The Kentucky Energy and Environment Cabinet is currently embroiled in a nearly $3 million lawsuit against Jim Justice and his son to make good on a 2014 agreement to fix violations on mines they own in Kentucky.

According to Ohio Valley ReSource, uncontrolled stormwater runoff from the Justices’ Bevins Branch surface mine in Pike County, Ky., has caused multiple instances of flooding since 2016. The Justice companies had previously agreed to finish reclamation on the mine by 2015.

In October 2018, floodwaters washed away the road to Elvis and Laura Thacker’s home, leaving them trapped as the water rose higher. While floodwaters didn’t reach their home that time, a June 2016 flood caused mold and approximately $148,000 in damages, according to Ohio Valley ReSource. The Thackers told the news organization that the company offered some money after the 2016 incident, but not nearly enough.

“The Justices’ companies mined Kentucky coal and profited from it,” cabinet spokesperson John Mura wrote in an email. “But they have dragged their feet for years in meeting their obligations to restore the land. The Cabinet is asking the Court to now enforce the agreement that the Justices signed, then breached. We are asking the Court to order the Justice Companies to complete the reclamation of approximately 12,202 feet of highwall and pay the nearly $3 million in penalties to the Commonwealth that the Justices personally guaranteed.”

An August 2018 motion filed by the cabinet in the Franklin Circuit Court outlines an ongoing pattern of hostility from representatives of the Justice family. This includes personal lawsuits the family filed against two state employees in July 2017. One lawsuit claimed that a state employee “maliciously” closed a Kentucky Fuel Corp. mine in July 2017, even though the employee did not issue the closure order. The state holds that the mine closure was proper because Kentucky Fuel Corp. allowed a lapse in their workers’ compensation coverage.

“The [Justices’] purpose in suing state officials is to intimidate the Kentucky government into renegotiating the August 15, 2014 Agreed Order on terms favorable to Jim and Jay Justice and their coal companies,” reads the motion.

“Because the [Justices] have no apprehensions about filing personal lawsuits based on falsehoods and fabrications, Cabinet employees have been instructed to avoid speaking with [Justice representatives] without a Cabinet attorney being present.”

On Jan. 29, the state of Kentucky reached a “settlement in principle with the Justice companies,” according to a Feb. 1 email from Mura. As of mid-February, the two parties were still engaged in negotiations for an agreement that satisfies all involved.

Taysha DeVaughan with Southern Appalachian Mountain Stewards states that going after Justice’s personal fortune for mine reclamation funds is “the most level-headed approach.” Referring to Kentucky’s ongoing lawsuit against the Justice family, DeVaughan says that Virginia officials “should not only follow in Kentucky’s footsteps, we should be in coordination, we should be talking to each other, we should be sharing strategies.”

“Justice is a billionaire, he is the governor of West Virginia, and he is the person who was in charge when all these things were happening,” she adds. “So if he has the funds that are available to make up for his mistakes, then he should do that, and I think the state should hold him accountable for that.”

Update: March 5, 2019

This article was updated to reflect West Virginia Gov. Jim Justice’s net worth of $1.5 billion as of March 5, 2019. This is down from $1.9 billion as of press time in late January.

Update: Feb. 18, 2019

This article was updated to reflect new information from Kentucky Energy and Environment Cabinet spokesperson John Mura regarding the state’s nearly $3 million lawsuit against the Justice family companies. The two parties reached “a settlement in principle” on Jan. 29 and continue to work toward a final agreement as of Feb. 18.

Related Articles

Latest News

Leave a comment

Your email address will not be published. Required fields are marked *

Leave a Comment