Faced with the threat of utility disconnection and even eviction in the pandemic, many North Carolinians are forced to decide between essentials

Kevin Ridder | May 5, 2021 | No Comments

Hundreds of thousands of North Carolina families have fallen behind on their utility bills. Making ends meet, many have had to rely on food distributions like this one organized by the Second Harvest Food Bank of Northwest N.C. Photo courtesy of Second Harvest

The culprit behind the exorbitant bill turned out to be a faulty wire in her home. In addition to losing a fridge full of food, the refrigerated insulin for Douglas’ 9-year-old diabetic son had also gone bad after losing power.

“So I explained to them everything and I’m just like, ‘How much do I have to pay?’ They told me I had to pay the whole $1,500,” said Douglas in an April 1 webinar hosted by Advance Carolina, a nonprofit organization aiming to build economic and political power for Black communities across the state.

When Douglas asked about getting on a payment plan, the utility company refused.

“He told me, ‘Absolutely not,’” said Douglas. “He said, ‘It’s the whole $1,500 or you can’t get your lights back on.’”

Over the next several days, Douglas struggled to find places for her family to sleep each night as her son’s condition worsened without enough insulin. She stated that 10 or 12 other people called Greenville Utilities on her behalf asking them to get the power turned back on.

After eight days, Douglas had to take her son to the hospital after he developed diabetic ketoacidosis from insufficient insulin. The utilities company then agreed to put her on a payment plan after Douglas borrowed money from family to pay part of the debt. Although a representative initially told her that she would only have to pay $100 a month toward the balance, another utility company employee told her that it would be $200 a month.

“I’m really, you know, I’m in a bind right now,” said Douglas in the webinar.

Before the pandemic, Douglas was a preschool teacher and drove for ride-sharing services like Uber and Lyft. Outside of work, Douglas raps and enjoys spending time outside with her kids. Her oldest son plays football while her younger son participates in mixed martial arts.

Douglas moved to Greenville right before Covid-19 broke out.

“Literally when I had an interview [at a preschool], covid hit,” says Douglas. “I was down here for a week, covid hit, and everything just stopped and went downhill. And then I caught covid myself while I was seven months pregnant.”

During the pandemic, Douglas’ days have been focused on helping her two oldest children with online school while taking care of her youngest.

“So it’s a lot going on for my kids just being, you know, just being housed at one time,” said Douglas during the webinar.

Activists across the state are calling on Gov. Roy Cooper and the N.C. Utilities Commission to reinstate a moratorium on utility disconnections and to extend eviction protections through at least Oct. 31. Among the groups advocating for the extension is Appalachian Voices, the nonprofit organization that publishes The Appalachian Voice.

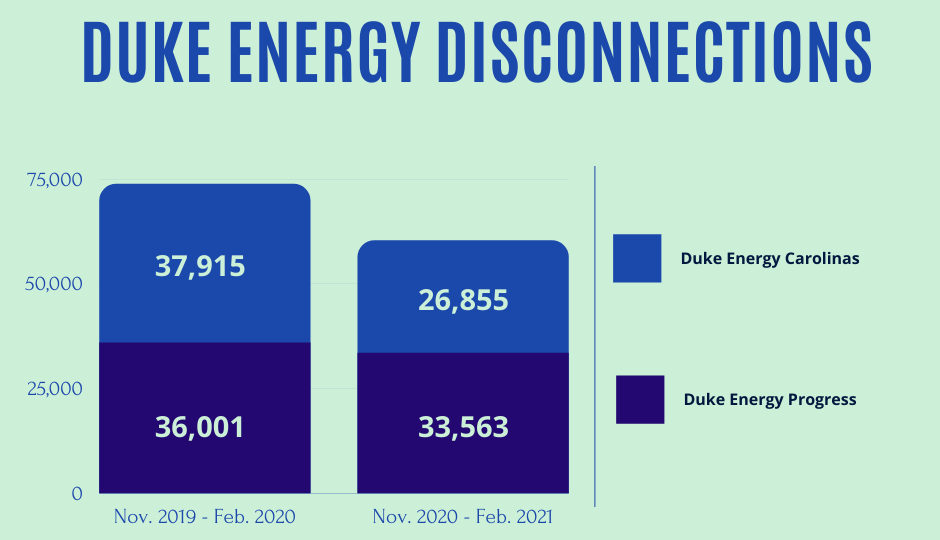

In the heat of the COVID-19 pandemic, Duke Energy disconnected nearly as many North Carolina families from November 2020 to February 2021 as they did in the same time period in the previous year. Source: N.C. Utilities Commission

On March 28, the Centers for Disease Control and Prevention extended a federal ban on evictions through June 30 that was set to expire at the end of March. Even with this moratorium, however, landlords have still managed to evict more than 300,000 Americans during the pandemic, according to Princeton University.

Energy insecurity, the struggle for people to maintain necessary energy services in their home, is a problem that has only gotten worse in the COVID-19 pandemic. Massive job loss and higher energy usage from people sheltering in place have made it especially difficult for people to keep the lights on.

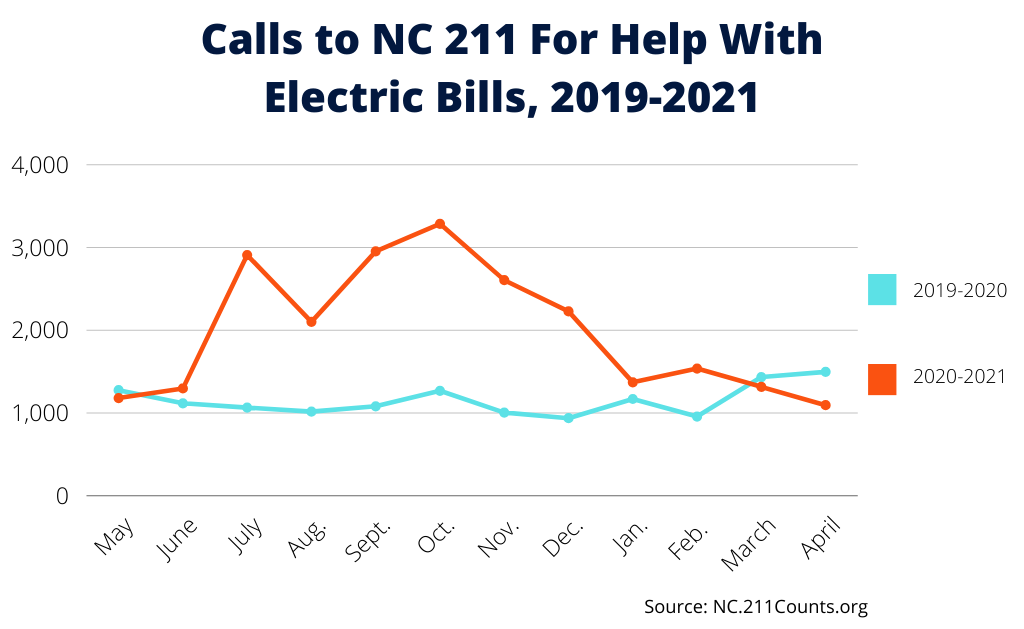

Requests to NC 211 for help paying electric bills dramatically increased in the months following the outbreak of COVID-19. Residents in any state can call 211 for free, confidential information on how to obtain assistance with basic needs. Source: NC.211counts.org

“Do we not eat food tonight because we have to pay this rent?” asks Greggs. “Do we not be able to give that lunch to our child when that child goes to school since schools are open? Those are the questions that, every day, have to be asked by people that shouldn’t have to.”

“It is a human right to be able to live, and no one’s utilities should be shut off,” she continues. “No one should have to worry about rent during a pandemic, and no one should have to worry about how to survive the next week.”

On April 30, Douglas said that her lease was up and they her family was in the process of moving their possessions to a storage unit. As for where the family will be moving to, Douglas says, “We have no idea. It’s just up in the air, we’re just trying to live day-by-day.”

She states that it was easy to find a place before the pandemic, but not anymore.

“It’s like everybody’s in competition just to get one thing,” says Douglas. “Everything’s off the market. It’s hard, it’s difficult, it’s frustrating.”

Cars line up at a mobile food distribution organized by Second Harvest Food Bank of Northwest North Carolina. Food bank visitation has skyrocketed during the COVID-19 pandemic. Photo courtesy of Second Harvest

As of March, approximately 55% more people across the country were visiting food banks than before the pandemic began, according to nonprofit food bank network Feeding America. The organization also estimates that one in eight Americans could face hunger in 2021.

Second Harvest Food Bank of Northwest North Carolina spokesperson Jenny Moore states that the food bank had a 30% to 40% increase in visitors over the winter.

“We have people who are still sleeping in their cars overnight to get food because they’re afraid they’re going to get turned away,” Moore says. “We actually have had to do that and still do that.”

Moore notes that when the food bank runs out of food, they give out grocery store gift cards so that nobody leaves empty-handed. During the pandemic, according to Moore, food banks have received increased funding from state and federal governments as well as from individual donors.

A note from a visitor of a drive-thru food distribution run by the Second Harvest Food Bank of Northwest N.C. Photo courtesy of Second Harvest

Moore is worried that some families facing months of past-due utility and rent bills will not be able to make up the costs. This could lead to utility disconnection or homelessness.

“Food alone is not going to solve hunger, it never will,” Moore says. “You have to deal with what’s underlying that.

A January 2021 study published in Nature estimated that approximately 2.4 million households across the country were unable to pay at least one energy bill from April to May 2020, with a projected 1.7 million receiving disconnection notices from their utility. Researchers estimate that nearly 50% of those families had their power turned off.

Hundreds of thousands of North Carolina families have fallen behind on their electric bills during the COVID-19 pandemic. Source: N.C. Utilities Commission

“Even at the end of February, we were looking at approximately 68,000 [electric and gas] disconnections overall [dating back to November 1],” she says. “That’s only a 20% difference between the year 2019 when we were not in the midst of a pandemic. The number should not be that close.”

Beyond a state-mandated utility shut-off moratorium, Lee states that long-term solutions are needed.

“We just really need to be focused on building out proper infrastructure so that we can handle things that may come our way and we don’t put the responsibility on our North Carolinians to bear the burden of lack of accountability or lack of policy or lack of preparedness,” Lee says. “That’s not the fault of North Carolinians. That’s the responsibility of our leadership.

“We can’t have another COVID-19 pandemic, because we weren’t prepared for this one. We won’t be prepared for the next one if it stays the same.”

Energy insecurity is an acute problem in the Southeast. The region has the highest residential bills in the contiguous United States despite having the lowest electric rates, according to a February 2021 report by the nonprofit Southeast Energy Efficiency Alliance.

Southeast Energy Efficiency Alliance Built Environment Project Manager William Bryan states that energy security is a question of affordability, access and physical infrastructure.

“Do you live in a house that makes it easier to keep the power on, or do you live in a house without insulation?” Bryan asks. “So it’s physical infrastructure, and then there’s also a behavior element because, well, a lot of people in our region have to make really difficult trade-offs to keep the lights on.”

“We’re seeing instances where people who are sheltering-in-place have more substantial bills than they would have otherwise,” he adds. “If you’re already living on a knife’s edge of ‘Yes, I can pay my bill this month,’ or ‘No, I can’t,’ then even just the fact of staying home can push you over the edge of not being able to afford your bill.”

Bryan emphasizes that utility disconnection moratoria don’t really address debt from mounting utility bills.

“I think this really underlines the need for more robust energy efficiency funding that is directed to income-qualified customers,” Bryan says.

Appalachian Voices Senior Energy Analyst Rory McIlmoil highlights a need for comprehensive solutions like income-based utility payment plans and home weatherization initiatives.

“What the pandemic has made clear is that we need policy solutions that address the underlying and pervasive problem of high energy cost burdens for low-income families,” McIlmoil says.

At the end of January, more than 600,000 North Carolina electric, gas and water accounts were past due, according to data reported to the N.C. Utilities Commission. This amounts to approximately $134.6 million in unpaid bills.

In a Feb. 23 order, the N.C. Utilities Commission required Duke Energy and other regulated utilities to allow at least 18 months for payments. Other unregulated utilities in the state offer six- or 12-month plans.

But Jovita Lee states that Duke and other regulated utilities have incorrectly told customers that they could only offer the shorter six- or 12-month plans. She attributes this to internal communication failures at the monopoly utility. While she and others have reached out to the utilities to correct the issue, ratepayers are still being given incorrect information.

“There’s a lack of accountability and a lack of urgency to correct the issue,” Lee says. “It kind of leaves folks in limbo because they’re thinking one thing when the truth is something else.”

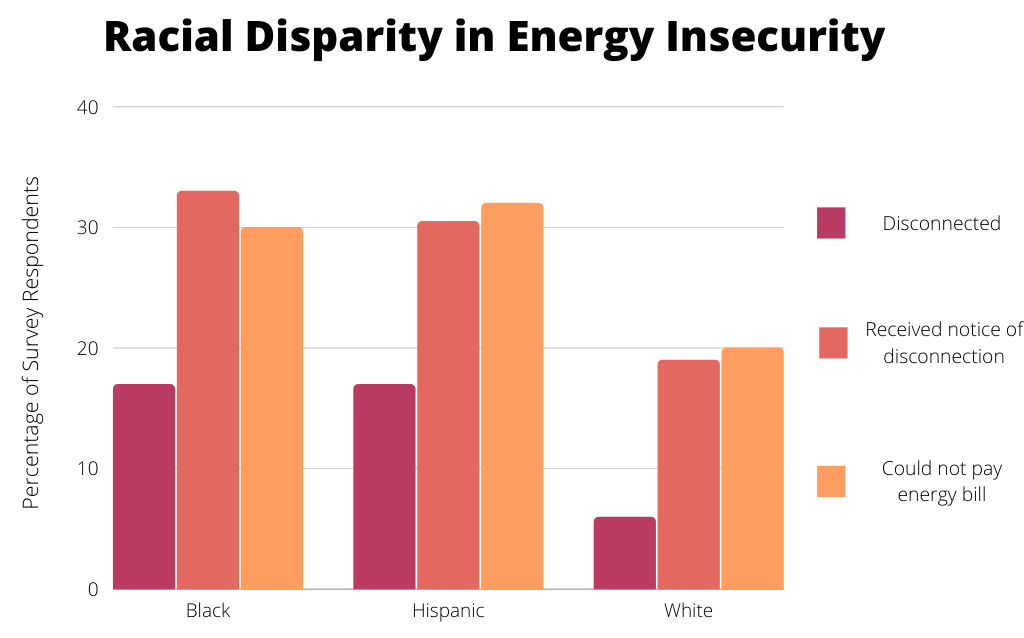

Before the pandemic, approximately one in three people in the Southeast struggled with energy insecurity, according to the Southeast Energy Efficiency Alliance. This issue disproportionately impacts Black and Brown communities in addition to rural and elderly residents, stemming from a long history of racial and economic inequities.

“More than a century ago white political leaders disenfranchised Black voters to exclude them from the region’s energy decision-making process, ensuring the benefits of the South’s first wave of electrification flowed primarily to white Southerners,” reads the SEEA’s February report. “The legacies of residential segregation continue to impede access to healthy and affordable housing for Black and Hispanic communities.”

A January 2021 study in Nature Energy found that Black and Hispanic households nationwide were more likely to experience energy insecurity than White households. The survey for this data was conducted in Spring 2020. Source: Memmott, T., Carley, S., Graff, M. et. al

“Shutoffs didn’t start with the pandemic,” Lee says. “There was a shutoff issue, especially with regulated utilities, prior to COVID-19 hitting the way that it did. That was already an equity issue, because of course it was mainly Black and Brown households or low-income households that were bearing the brunt of having arrears for their utilities. And so all that COVID-19 did was exacerbate that issue.”

In the April 1 webinar hosted by Advance Carolina, attorney Yolanda Taylor with nonprofit law firm Legal Aid NC highlighted the racial and economic disparities of utility disconnection and evictions.

“Nationally, one in four Black renters lived in a county where the Black eviction rate was more than double the white eviction rate,” Taylor wrote in the webinar chat. “In regard to utilities, a September 2020 national survey showed that, as compared to white households, Hispanic households were 15 times more likely to be disconnected for the first time, since the beginning of the pandemic, and Black households were 6 times more likely. At the same time, Black and Hispanic residents in North Carolina are contracting and dying from COVID-19 at disproportionately higher rates.”

Eviction and utility disconnection moratoria have a direct impact on COVID-19 infection and death rates, according to a January 2021 study by the National Bureau of Economic Research. Researchers found that policies that limit evictions reduced COVID-19 infections by 3.8% and deaths by 11%, while moratoria on utility disconnections reduced infection by 4.4% and mortality rates by 7.4%.

“It can be inferred that potentially hundreds of North Carolina residents have died as a direct result of having their utilities disconnected for non-payment since the expiration of Governor Cooper’s moratorium on disconnections,” wrote Taylor.

A variety of federal eviction prevention measures have been in place since last spring. Under the current moratorium issued by the CDC, tenants are not supposed to be evicted for nonpayment until June 30. But local housing courts in North Carolina and across the country have interpreted the CDC’s order differently.

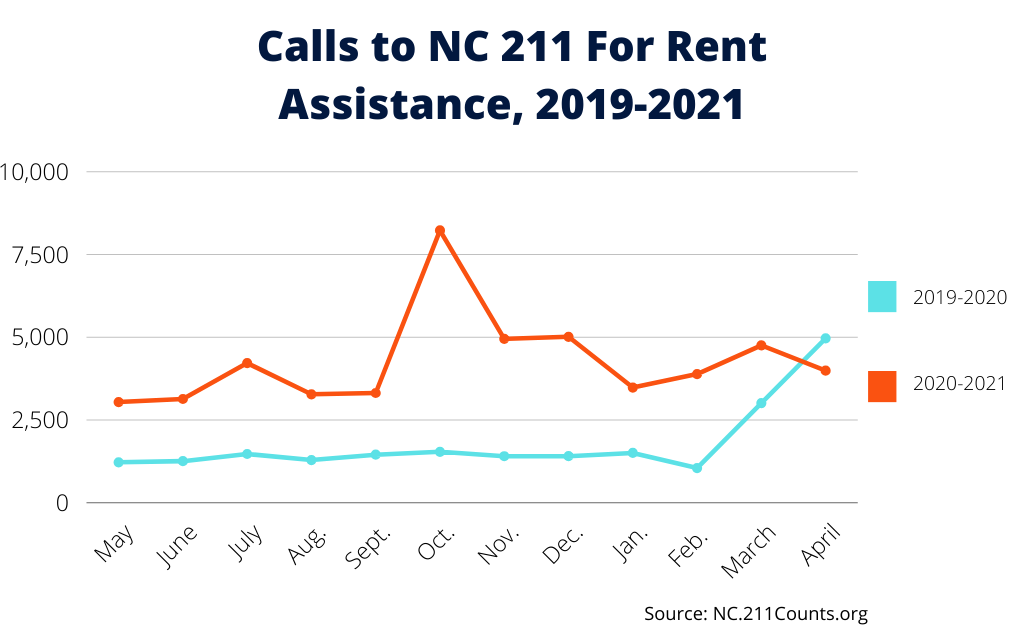

Requests to NC 211 for rent assistance dramatically increased in the months following the outbreak of COVID-19. Residents in any state can call 211 for free, confidential information on how to obtain assistance with basic needs. Source: NC.211counts.org

Some of these methods include claiming tenants broke terms of the lease, declining to renew a lease and raising security deposits on modest housing by thousands of dollars. Taylor states that some landlords have been hostile toward tenants when provided with an eviction protection form.

“I’ve had some cases where the landlord actually tore up the letter,” she says.

To Taylor’s knowledge, local courts have not gotten any direction from the state as to how to enforce the federal moratorium.

“It feels like the wild, wild West out here,” says Taylor. “You don’t have uniformity [across housing courts].”

In Western North Carolina, nonprofit law firm Pisgah Legal Services provides pro bono legal aid to disadvantaged residents. Attorney David Bartholomew states that the firm had 772 tenant-landlord cases from July to December 2020, compared to 338 in the last half of 2019. He notes that there has been confusion surrounding the different eviction protection measures.

“We’ve had a lot of people calling about the changes in the law, the new orders, trying to understand what their rights are,” Bartholomew says.

He states that Pisgah Legal Services is preparing for a spike in eviction cases once the CDC moratorium ends.

“A lot of landlords are working with their tenants and we’re hopeful that, as the economy comes back and people return to work, there could be an opportunity to share in the losses and find new leases,”Bartholomew says. “But we also know that money is not coming back, and we’re preparing to be available to as many people facing eviction as possible.”

In October 2020, North Carolina opened the Housing Opportunity to Prevent Evictions program up for applications. Funded by $167 million in federal dollars with an additional $545 million from the federal March COVID relief bill on the way, the HOPE program is meant to provide rent and utility assistance to renters financially impacted by the pandemic.

But after less than a month and tens of thousands of applications, the HOPE program stopped accepting new requests. Many who were approved for the program have yet to receive any funds. As of March 25, North Carolina had only paid out approximately $99.3 million of the more than $140.5 million it awarded, according to WTVD-TV. This has left many waiting for HOPE program funds as landlords and utility companies continue to demand payment.

Misinformation and a breakdown in communication has also plagued the HOPE program. In the April 1 webinar on housing insecurity in North Carolina, Charlotte resident Serita Russell shared her story. Russell has owned and operated her tax preparation business S&R Financial Solutions since 2003. She is also an activist with Action NC’s Tenant Organizing Resource Center, which works to empower tenants in substandard housing.

“I am a strong, independent woman who is always willing to lend a helping hand,” said Russell. “I’m a passionate writer, I love to travel, I love photography, swimming, reading, playing tennis and spending time with my family and friends and helping others. In addition to all of these things, most importantly, I am a seven-year breast cancer survivor.”

After losing work near the beginning of the pandemic, Russell fought against eviction for months. Due to health issues, she is unable to work full-time.

Russell applied for HOPE program funding and was approved in December 2020. But when her landlord received it, the landlord said they could not approve it as Russell had received assistance from another program. Although Russell’s caseworker told her that it was not a problem, the landlord elected not to sign the contract to receive HOPE funds.

In January, Russell received a late notice on rent. She then emailed her caseworker and the collections specialist asking about the late notice.

“Well, he wrote back and said that it was a protocol for the rental companies to do that, to send out late notices,” said Russell. “The collections specialist also replied back to me and said, ‘Yes, Serita, this is protocol that we do.’”

When she reached out for an update on Jan. 15, the collections specialist told Russell that they had signed the contract and were waiting on HOPE funding.

“Well time went by, and I was waiting to hear from someone, never heard anything back,” said Russell. “On Feb. 15, I received an eviction notice and a summons on my front door.”

Several days went by as Russell left voicemails with the caseworker and collections specialist. When the collections specialist called back, they informed her that they had never signed the contract. She also had received disconnection notices from her electric and water utilities, and had to get on a payment plan.

“I was upset, because I was misled to believe that I was getting the help that I so desperately needed,” Russell said.

After another round of communications and contract revisions, Russell received a call on March 26 from her caseworker letting her know that funds had been released. Several days later, her landlord dismissed the eviction case. Russell stated on May 3 that her landlord still has not received payment from the HOPE program.

“I feel that the ball was dropped on both parts,” Russell said. “I feel that they misled me into believing that they had signed the contract and were waiting on funding when, in fact, no contract was ever signed. I waited months thinking that funds from the program were on the way to help save me from an eviction.”

Russell is passionate about helping others who are dealing with substandard housing or facing eviction. In 2019, she organized her neighbors at Lake Arbor Apartments into a tenants union to force management to address water damage, mold structural issues and other code violations. The tenants filed suit against management in 2019 for unlawfully collecting rent at apartments with dangerous conditions between 2015 and 2019, according to the Charlotte Post. Rather than fix these issues, management evicted all residents in July 2019 and sold the property.

“Since there is a lack of affordable housing, many people ended up living in hotels long-term,” said Russell during the webinar. “Almost two years later, some tenants are still in the same living situations now.”

On March 16, a judge approved a $547,500 settlement for 106 former Lake Arbor residents, according to WBTV.

“I hope that communities around the city, state and other places will see that there is the possibility to win and fight against landlords, slumlords as we call them,” Russell told WBTV on March 17.

During the April 1 webinar, Russell stated that she and others with Action NC see people being threatened by eviction all the time.

“The pandemic has magnified this crisis even more,” said Russell. “Even though the eviction moratorium has been extended, renters are still getting evicted because of loss of income due to the Covid-19 pandemic.”

Unless the federal eviction moratorium is extended before June 30, millions of Americans could face homelessness. Many in North Carolina and across the country are still facing the threat of having their power turned off without a disconnection moratorium in place.

Fayetteville P.A.C.T. President Kathy Greggs states that elected officials aren’t doing enough to address housing and energy insecurity.

“You serve the people, you get paid by the people,” Greggs says. “If you don’t have the decency or the compassion to understand that people should be able to live comfortably just like you do when you go home, then you should not hold any seat or any elected official position until you understand. It is your moral obligation to fight for humanity.”

If you live in North Carolina and are facing utility disconnections or eviction, you can contact Action NC at (980) 443-3715 or actionnc.org/torc_nc for assistance.

Editor’s Note: This story was updated on May 6, 2021.

Like this content? Subscribe to The Voice email digests